Rising Focus on Sustainable Technology

The growing emphasis on sustainability is influencing the reram market. As organizations strive to reduce their carbon footprint, energy-efficient memory solutions are becoming increasingly important. Reram technology is known for its low power consumption, which aligns with the sustainability goals of many companies. This trend is particularly relevant in sectors such as data centers and telecommunications, where energy costs are a significant concern. By adopting reram solutions, businesses can not only enhance performance but also contribute to environmental sustainability. The market is expected to see a surge in demand as more companies prioritize eco-friendly technologies in their operations.

Growing Demand for High-Performance Computing

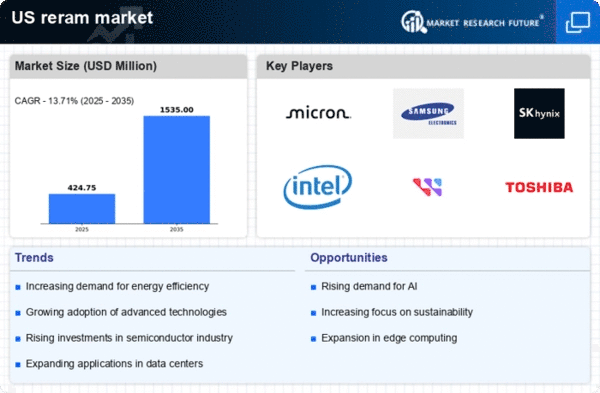

The increasing need for high-performance computing solutions is driving the reram market. Industries such as artificial intelligence, machine learning, and data analytics require advanced memory technologies to process vast amounts of data efficiently. Reram technology offers superior speed and energy efficiency compared to traditional memory solutions, making it an attractive option for these applications. As organizations invest in infrastructure to support data-intensive workloads, the reram market is expected to experience substantial growth. In 2025, the market is projected to reach a valuation of approximately $2 billion, reflecting a compound annual growth rate (CAGR) of around 15%. This trend indicates a robust demand for reram solutions in sectors that prioritize performance and efficiency.

Technological Advancements in Memory Solutions

Innovations in memory technology are significantly impacting the reram market. Research and development efforts are focused on enhancing the performance and scalability of reram solutions. These advancements include improvements in manufacturing processes, which reduce costs and increase yield. Furthermore, the integration of reram with emerging technologies such as neuromorphic computing and edge computing is creating new opportunities for market expansion. As companies seek to leverage these innovations, the reram market is likely to benefit from increased adoption across various sectors. The potential for reram to outperform traditional memory types in terms of speed and energy consumption positions it favorably in the competitive landscape.

Increased Investment in Research and Development

Investment in research and development (R&D) is a critical driver for the reram market. Companies are allocating substantial resources to explore new applications and improve existing technologies. This focus on R&D is essential for maintaining competitiveness in a rapidly evolving landscape. As organizations seek to innovate and differentiate their offerings, the reram market stands to benefit from these investments. In 2025, R&D spending in the semiconductor industry is projected to exceed $40 billion, with a significant portion directed towards memory technologies. This influx of funding is likely to accelerate the development of advanced reram solutions, further propelling market growth.

Expansion of Internet of Things (IoT) Applications

The proliferation of Internet of Things (IoT) devices is creating new opportunities for the reram market. As IoT applications become more prevalent, the demand for efficient and reliable memory solutions is increasing. Reram technology is well-suited for IoT devices due to its low power consumption and high performance. This compatibility positions reram as a preferred choice for manufacturers looking to enhance the functionality of their products. The IoT market is expected to grow significantly, with estimates suggesting it could reach $1 trillion by 2025. This growth will likely drive demand for reram solutions, as companies seek to optimize their devices for performance and energy efficiency.