Expansion of Retail Outlets

The expansion of retail outlets, particularly in urban areas, is a key driver for the refrigerated display-cases market. As new grocery stores, convenience stores, and supermarkets emerge, the need for effective refrigeration solutions becomes paramount. The US retail sector has seen a steady increase in the number of grocery stores, with a reported growth of 3.5% in 2025. This expansion necessitates the installation of refrigerated display-cases to maintain product quality and safety. Retailers are investing in diverse display options to cater to various consumer preferences, further propelling the market's growth.

Rising Demand for Fresh Food

The increasing consumer preference for fresh and organic food products is driving the refrigerated display-cases market. As health-conscious consumers seek out fresh produce, dairy, and meats, retailers are compelled to invest in advanced refrigerated display solutions. According to recent data, the fresh food segment is projected to grow at a CAGR of 5.2% through 2026, indicating a robust demand for effective refrigeration systems. This trend necessitates the deployment of energy-efficient and visually appealing refrigerated display-cases, which can enhance product visibility and reduce spoilage. Consequently, the refrigerated display-cases market will likely experience significant growth as retailers adapt to these evolving consumer preferences.

Consumer Trends Towards Energy Efficiency

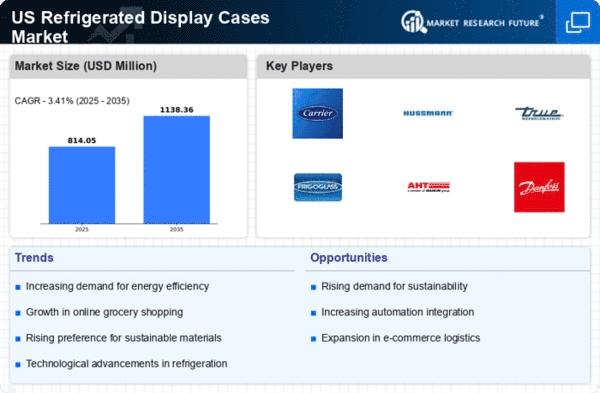

The growing consumer awareness regarding energy efficiency is shaping the refrigerated display-cases market. As energy costs rise, retailers are increasingly seeking energy-efficient refrigeration solutions to reduce operational expenses. The market for energy-efficient display-cases is projected to grow by 4.8% annually, driven by the demand for sustainable practices. Retailers are investing in eco-friendly technologies that not only lower energy consumption but also appeal to environmentally conscious consumers. This shift towards energy efficiency is likely to enhance the competitive landscape of the refrigerated display-cases market, as businesses strive to meet both consumer expectations and regulatory requirements.

Technological Advancements in Refrigeration

Innovations in refrigeration technology are significantly impacting the refrigerated display-cases market. The introduction of smart refrigeration systems, which utilize IoT and AI, allows for real-time monitoring and optimization of temperature and humidity levels. This not only enhances food safety but also reduces energy consumption, aligning with sustainability goals. The market for smart refrigeration is expected to reach $1.5 billion by 2027, reflecting a growing trend towards automation and efficiency. Retailers are increasingly adopting these advanced systems to improve operational efficiency and reduce costs, thereby driving the demand for modern refrigerated display-cases.

Regulatory Compliance and Food Safety Standards

Stringent food safety regulations and compliance requirements are influencing the refrigerated display-cases market. The US government has implemented various standards to ensure food safety, which necessitates the use of reliable refrigeration systems. Retailers must adhere to these regulations to avoid penalties and ensure consumer trust. The market for refrigerated display-cases is expected to grow as businesses invest in compliant solutions that meet health and safety standards. This trend highlights the importance of maintaining optimal storage conditions for perishable goods, thereby driving demand for advanced refrigeration technologies.