Public Awareness and Education

Public awareness regarding the benefits of recycling and sustainable construction practices is increasingly influencing the recycled construction-aggregates market. Educational campaigns and community initiatives are fostering a greater understanding of the environmental impacts of construction waste. As awareness grows, consumers and builders alike are more inclined to choose recycled materials. This shift in mindset is crucial, as it encourages the adoption of recycled aggregates in various construction projects. The recycled construction-aggregates market is likely to expand as public demand for sustainable practices continues to rise, prompting more companies to incorporate recycled materials into their offerings.

Regulatory Framework and Incentives

The regulatory environment surrounding construction practices is evolving, with an increasing number of policies promoting the use of recycled materials. In the US, various states have implemented regulations that encourage or mandate the use of recycled aggregates in public projects. These regulations not only support environmental goals but also create a more favorable market for recycled construction-aggregates. Additionally, financial incentives such as tax breaks or grants for using sustainable materials further stimulate market growth. As these regulatory frameworks become more prevalent, the recycled construction-aggregates market is expected to experience a boost in demand, driven by compliance and incentive-based motivations.

Infrastructure Development Initiatives

Ongoing infrastructure development initiatives in the US are a significant driver for the recycled construction-aggregates market. With the government investing heavily in infrastructure projects, there is a growing need for construction materials that are both sustainable and cost-effective. The Biden administration's infrastructure plan, which allocates $1.2 trillion for various projects, is expected to create a surge in demand for recycled aggregates. This demand is likely to be fueled by the desire to utilize materials that minimize environmental impact while supporting economic growth. Consequently, the recycled construction-aggregates market stands to gain from these initiatives as more projects prioritize the use of recycled materials.

Growing Demand for Sustainable Materials

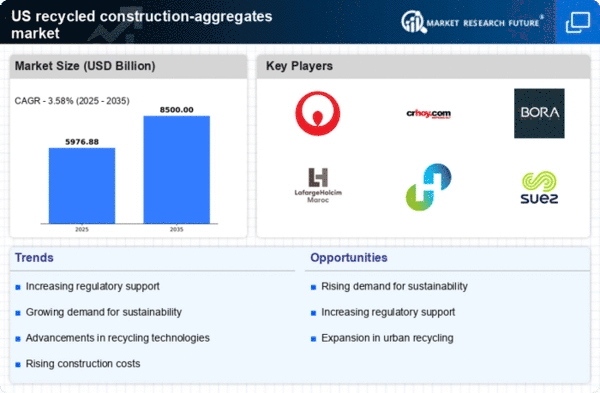

The increasing emphasis on sustainability within the construction sector is a primary driver for the recycled construction-aggregates market. As stakeholders become more environmentally conscious, the demand for sustainable building materials rises. In 2025, it is estimated that the market for recycled aggregates could reach approximately $10 billion in the US, reflecting a growing preference for eco-friendly alternatives. This shift is not only driven by consumer preferences but also by the need for construction companies to enhance their corporate social responsibility profiles. The recycled construction-aggregates market is thus positioned to benefit from this trend, as more projects incorporate recycled materials to meet sustainability goals.

Cost-Effectiveness of Recycled Aggregates

The economic advantages associated with using recycled aggregates significantly influence the recycled construction-aggregates market. Recycled materials often present a lower cost compared to virgin aggregates, which can lead to substantial savings for construction projects. In the US, the cost of recycled aggregates can be up to 30% less than traditional materials, making them an attractive option for budget-conscious builders. This cost-effectiveness is particularly appealing in large-scale projects where material expenses can accumulate rapidly. As the construction industry continues to seek ways to reduce costs while maintaining quality, the recycled construction-aggregates market is likely to see increased adoption of these materials.