Growth of Automotive Electronics

The automotive industry in the US is undergoing a transformation, with a marked increase in the integration of electronic systems. This shift is propelling the radio frequency component market forward, as vehicles increasingly rely on advanced communication technologies. The market for automotive electronics is projected to reach $300 billion by 2026, with radio frequency components playing a crucial role in vehicle-to-everything (V2X) communication systems. These components facilitate real-time data exchange between vehicles, infrastructure, and other road users, enhancing safety and efficiency. As automakers invest in connected and autonomous vehicle technologies, the demand for high-quality radio frequency components is expected to rise significantly. This trend indicates a promising future for the radio frequency-component market as it aligns with the broader evolution of the automotive sector.

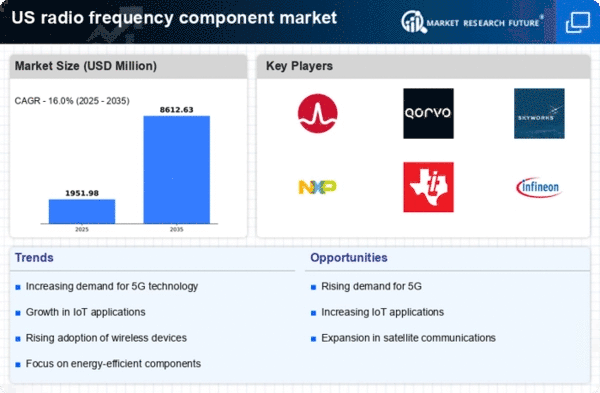

Increased Adoption of 5G Technology

The ongoing rollout of 5G technology in the US is a pivotal driver for the radio frequency component market. As telecommunications companies expand their 5G networks, the demand for advanced radio frequency components is surging. These components are essential for enabling high-speed data transmission and improved connectivity. The radio frequency-component market is projected to witness a growth rate of approximately 25% annually, driven by the need for enhanced network infrastructure. This trend is further supported by investments from major telecom operators, which are expected to exceed $100 billion in the next few years. Consequently, the radio frequency-component market is likely to experience significant growth as 5G technology becomes more prevalent across various sectors, including automotive, healthcare, and smart cities.

Emergence of Smart Home Technologies

The rise of smart home technologies is a notable driver for the radio frequency component market. As consumers increasingly adopt smart devices for home automation, the demand for reliable radio frequency components is growing. The smart home market in the US is anticipated to reach $100 billion by 2025, with radio frequency components being integral to the functionality of devices such as smart speakers, security systems, and lighting controls. These components enable seamless communication between devices, enhancing user experience and convenience. Manufacturers are responding to this trend by innovating and producing components that support various wireless protocols, such as Zigbee and Z-Wave. Consequently, the radio frequency-component market is likely to benefit from the ongoing expansion of smart home technologies, reflecting a shift in consumer preferences towards connected living.

Expansion of Wireless Communication Systems

The expansion of wireless communication systems in the US is significantly influencing the radio frequency component market. With the increasing reliance on wireless technologies for communication, there is a growing need for efficient radio frequency components. This market is expected to grow at a CAGR of around 20% over the next five years, driven by the proliferation of mobile devices and the Internet of Things (IoT). The demand for high-performance antennas, amplifiers, and filters is rising as industries seek to enhance their wireless communication capabilities. Furthermore, the radio frequency-component market is benefiting from advancements in materials and manufacturing processes, which are enabling the production of smaller, more efficient components. This trend is likely to continue as businesses and consumers alike demand faster and more reliable wireless communication solutions.

Surge in Defense and Aerospace Applications

The defense and aerospace sectors are increasingly relying on advanced radio frequency components, which is driving growth in the radio frequency component market. The US government has allocated substantial budgets for defense spending, with an estimated $750 billion earmarked for 2025. This funding is directed towards enhancing communication systems, radar technologies, and electronic warfare capabilities, all of which require sophisticated radio frequency components. As a result, manufacturers are focusing on developing specialized components that meet the stringent requirements of these industries. The radio frequency-component market is likely to see a robust increase in demand as defense contracts expand and new technologies are integrated into military applications. This trend underscores the critical role that radio frequency components play in ensuring national security and operational effectiveness.