Growth of Mobile Advertising

The proliferation of mobile devices is significantly impacting the programmatic display-advertising market. With over 80% of internet users in the US accessing content via mobile devices, advertisers are increasingly allocating budgets towards mobile programmatic advertising. This shift is indicative of a broader trend where mobile ad spending is projected to reach $100 billion by 2025, representing a substantial portion of the overall digital advertising landscape. The ability to deliver ads in real-time on mobile platforms enhances engagement and conversion rates, making mobile programmatic advertising an essential component of modern marketing strategies. Consequently, the programmatic display-advertising market is poised for growth as businesses adapt to the mobile-first consumer behavior.

Emergence of Video Advertising

The rise of video content consumption is reshaping the programmatic display-advertising market. As consumers increasingly engage with video across various platforms, advertisers are recognizing the potential of video ads to capture attention and drive engagement. By 2025, video advertising is projected to represent over 30% of total programmatic ad spending in the US. This trend is driven by the growing popularity of streaming services and social media platforms that prioritize video content. Advertisers are leveraging programmatic technologies to deliver video ads to targeted audiences, enhancing brand visibility and consumer interaction. Thus, the programmatic display-advertising market is likely to expand as video becomes a dominant format in digital advertising.

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) into the programmatic display-advertising market is transforming how advertisers approach campaign management. AI technologies facilitate enhanced data analysis, enabling advertisers to make informed decisions based on consumer behavior and preferences. In 2025, it is anticipated that AI-driven programmatic advertising will account for nearly 50% of all programmatic ad spend in the US. This shift not only streamlines the ad buying process but also improves targeting accuracy and campaign effectiveness. As AI continues to evolve, the programmatic display-advertising market is likely to witness increased efficiency and effectiveness, allowing advertisers to maximize their return on investment.

Rising Demand for Targeted Advertising

The programmatic display-advertising market is experiencing a notable surge in demand for targeted advertising solutions. Advertisers are increasingly seeking to reach specific demographics and consumer segments, which is driving the adoption of programmatic technologies. In 2025, it is estimated that targeted advertising will account for approximately 70% of total digital ad spending in the US, highlighting the importance of precision in ad placements. This trend is further fueled by advancements in data analytics and machine learning, enabling advertisers to optimize their campaigns in real-time. As a result, the programmatic display-advertising market is likely to expand, as businesses recognize the value of personalized marketing strategies that resonate with their audiences.

Increased Investment in Programmatic Solutions

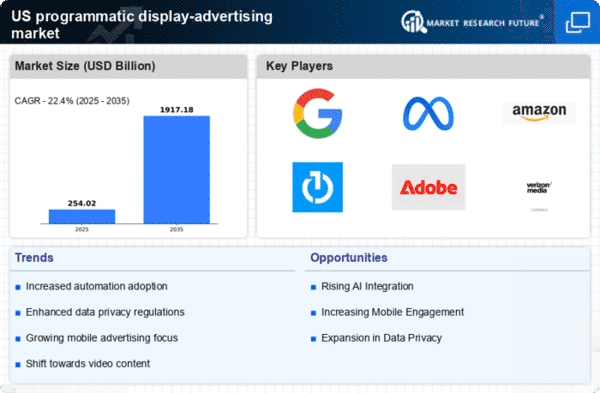

There is a marked increase in investment in programmatic solutions within the advertising industry. Businesses are recognizing the efficiency and effectiveness of programmatic advertising, leading to a projected growth rate of 20% annually in the programmatic display-advertising market. This investment trend is driven by the need for real-time data analysis and the ability to optimize campaigns dynamically. As companies allocate more resources towards programmatic technologies, the market is expected to evolve, offering more sophisticated tools and platforms for advertisers. This influx of investment is likely to enhance competition and innovation within the programmatic display-advertising market, ultimately benefiting advertisers and consumers alike.