Rising Operational Costs

The increasing operational costs across various industries in the US are driving the predictive maintenance market. Companies are seeking ways to optimize their maintenance strategies to reduce downtime and enhance productivity. According to recent data, unplanned downtime can cost businesses up to $260,000 per hour, prompting organizations to invest in predictive maintenance solutions. By leveraging advanced analytics and real-time monitoring, businesses can identify potential equipment failures before they occur, thereby minimizing costly interruptions. This trend indicates a growing recognition of the value of predictive maintenance in maintaining operational efficiency and reducing overall costs. As organizations strive to improve their bottom line, this market is likely to experience significant growth.

Growing Demand for Asset Longevity

The growing demand for asset longevity is a key driver of the predictive maintenance market. Organizations are increasingly recognizing the importance of extending the lifespan of their equipment to maximize return on investment. Predictive maintenance strategies enable companies to monitor asset health continuously and perform maintenance only when necessary, thus reducing wear and tear. This approach not only enhances the longevity of assets but also contributes to cost savings. As industries strive to optimize their asset management practices, the predictive maintenance market is expected to expand. The emphasis on asset longevity reflects a broader trend towards sustainable practices in maintenance and operations.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are becoming increasingly stringent in various sectors, thereby impacting the predictive maintenance market. Industries such as manufacturing, energy, and transportation are required to adhere to specific regulations that mandate regular equipment inspections and maintenance. Failure to comply can result in hefty fines and operational shutdowns. As a result, organizations are turning to predictive maintenance solutions to ensure compliance and enhance safety. The predictive maintenance market is likely to benefit from this trend, as companies seek to implement proactive maintenance strategies that align with regulatory requirements. This focus on compliance not only mitigates risks but also fosters a culture of safety within organizations.

Technological Advancements in Data Analytics

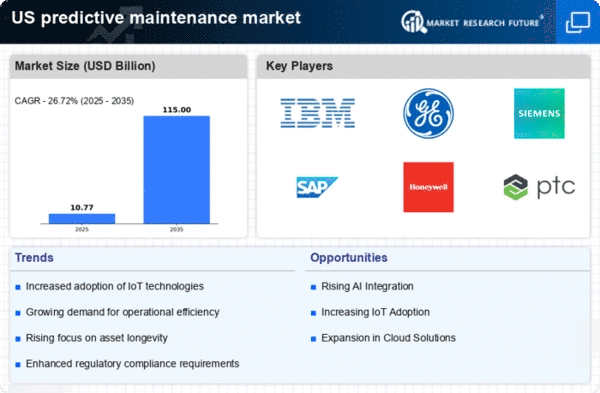

Technological advancements in data analytics are significantly influencing the predictive maintenance market. The ability to process vast amounts of data in real-time allows organizations to gain insights into equipment performance and maintenance needs. With the integration of advanced analytics tools, companies can predict failures with greater accuracy, leading to more effective maintenance strategies. The predictive maintenance market is projected to reach $10 billion by 2026, driven by these technological innovations. As industries increasingly adopt data-driven decision-making, the demand for predictive maintenance solutions is expected to rise, enabling organizations to enhance their operational efficiency and reduce maintenance costs.

Shift Towards Automation and Smart Manufacturing

The shift towards automation and smart manufacturing is significantly shaping the predictive maintenance market. As industries adopt Industry 4.0 principles, the integration of smart technologies and automation systems is becoming commonplace. Predictive maintenance plays a crucial role in this transformation by enabling real-time monitoring and analysis of equipment performance. This shift is expected to drive the predictive maintenance market, as organizations seek to leverage automation to enhance operational efficiency and reduce maintenance costs. The increasing reliance on automated systems highlights the need for predictive maintenance solutions that can seamlessly integrate with existing technologies, ensuring optimal performance and reliability.