Rising Popularity of DIY Projects

The power tool-battery market is experiencing growth due to the rising popularity of DIY projects among consumers. As more individuals engage in home improvement and creative projects, the demand for reliable and efficient power tools is increasing. This trend is particularly evident in the surge of sales for battery-operated tools, which offer convenience and ease of use. In 2025, it is estimated that the DIY segment will contribute significantly to the overall power tool sales, further driving the need for advanced battery solutions. Consequently, the power tool-battery market is likely to expand as manufacturers respond to the growing consumer interest in DIY activities.

Increased Focus on Energy Efficiency

The power tool-battery market is witnessing a heightened focus on energy efficiency, driven by both consumer preferences and regulatory standards. As energy costs rise, users are increasingly seeking tools that offer longer run times and reduced energy consumption. This trend is prompting manufacturers to innovate and produce batteries that not only meet performance expectations but also adhere to energy efficiency guidelines. In 2025, it is anticipated that energy-efficient batteries will represent a significant portion of the market, as consumers prioritize sustainability in their purchasing decisions. This shift is likely to reshape the power tool-battery market landscape, encouraging the development of eco-friendly battery solutions.

Growing Demand for Cordless Power Tools

The increasing preference for cordless power tools is significantly impacting the power tool-battery market. As consumers and professionals alike seek greater mobility and convenience, the demand for batteries that support cordless tools is on the rise. In 2025, it is estimated that cordless tools will account for over 60% of the total power tool sales in the US. This shift is prompting manufacturers to focus on developing more efficient and longer-lasting batteries, which is likely to drive innovation within the power tool-battery market. The convenience of cordless tools, combined with advancements in battery technology, is expected to further propel market growth.

Technological Advancements in Battery Chemistry

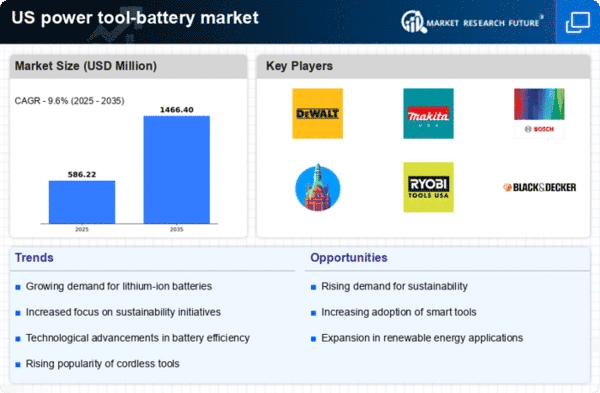

The power tool-battery market is experiencing a notable shift due to advancements in battery chemistry. Innovations such as solid-state batteries and improved lithium-ion formulations are enhancing energy density and reducing charging times. These developments are crucial as they allow power tools to operate longer on a single charge, thereby increasing efficiency for users. The market is projected to grow at a CAGR of approximately 8% over the next five years, driven by these technological improvements. As manufacturers invest in research and development, the power tool-battery market is likely to see a surge in high-performance batteries that cater to both professional and DIY users, ultimately transforming user experiences.

Expansion of the Construction and Renovation Sectors

The power tool-battery market is benefiting from the expansion of the construction and renovation sectors in the US. As infrastructure projects and home renovations gain momentum, the demand for power tools, particularly those powered by batteries, is increasing. The construction industry is projected to grow by approximately 5% annually, which directly correlates with the rising need for efficient power tools. This growth is likely to stimulate demand for high-capacity batteries that can support prolonged use in demanding environments. Consequently, the power tool-battery market is positioned to thrive as it aligns with the needs of a booming construction sector.