Growth in Consumer Electronics

The consumer electronics sector is a substantial driver for the power amplifier market. As consumers increasingly demand high-quality audio and video experiences, manufacturers are integrating advanced power amplifiers into their products. In 2025, the US consumer electronics market is anticipated to exceed $400 billion, with a notable portion allocated to audio and visual equipment that relies on power amplifiers. The power amplifier market is poised to capitalize on this trend, as companies strive to enhance sound quality and performance in home theaters, portable speakers, and other devices. This growth presents opportunities for innovation in amplifier design and efficiency.

Rising Adoption of IoT Devices

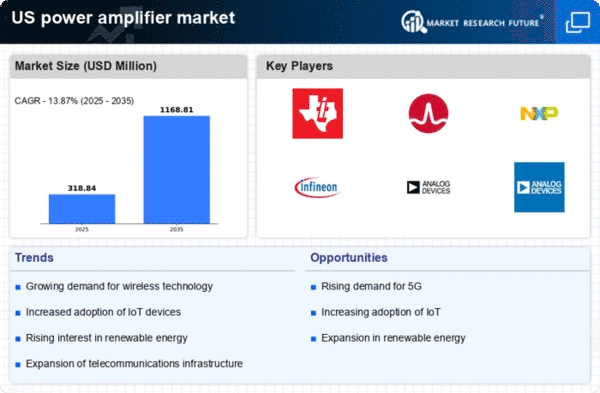

The proliferation of Internet of Things (IoT) devices is a key driver for the power amplifier market. As more devices become interconnected, the demand for efficient power amplifiers increases. In 2025, the number of IoT devices in the US is projected to reach over 30 billion, necessitating robust power amplification solutions to support their functionality. This trend indicates a growing need for power amplifiers that can handle diverse applications, from smart home devices to industrial automation. The power amplifier market is likely to benefit from this surge, as manufacturers innovate to meet the specific requirements of IoT applications, including size, efficiency, and performance.

Advancements in Automotive Technology

The automotive sector is rapidly evolving, with advancements in electric vehicles (EVs) and autonomous driving technologies driving demand for power amplifiers. As vehicles become more sophisticated, the need for high-performance amplifiers to support infotainment systems and communication technologies is increasing. The power amplifier market is expected to grow as automakers integrate these technologies into their designs. In 2025, the US EV market is projected to reach $100 billion, highlighting the potential for power amplifiers to enhance vehicle performance and user experience. This trend indicates a shift towards more integrated and efficient power solutions in the automotive landscape.

Increased Investment in Renewable Energy

The shift towards renewable energy sources is influencing the power amplifier market. As the US invests more in solar and wind energy, the need for efficient power management systems becomes critical. Power amplifiers play a vital role in converting and managing energy from these sources. The power amplifier market is likely to experience growth as companies develop amplifiers that can handle the unique challenges posed by renewable energy systems. This trend suggests a potential increase in demand for specialized amplifiers that can optimize energy conversion and distribution, aligning with the broader goals of sustainability and energy efficiency.

Expansion of Wireless Communication Technologies

The ongoing expansion of wireless communication technologies significantly impacts the power amplifier market. With the rollout of 5G networks across the US, there is an increasing demand for high-performance power amplifiers that can support higher frequencies and greater data throughput. The power amplifier market is expected to see a growth rate of approximately 15% annually as telecom companies invest heavily in infrastructure to enhance connectivity. This shift towards advanced wireless communication necessitates the development of power amplifiers that can operate efficiently under varying conditions, thereby driving innovation and competition within the market.