Increased Focus on Sustainability

Sustainability has emerged as a key consideration for consumers and businesses alike, influencing purchasing decisions in the portable scanner market. As organizations strive to reduce their carbon footprint, the demand for eco-friendly office solutions is on the rise. Portable scanners, which facilitate paperless workflows, align with these sustainability goals by minimizing paper usage and promoting efficient document management. In November 2025, the market is witnessing a growing trend where consumers are actively seeking products that contribute to environmental conservation. This shift indicates a potential for portable scanners to play a crucial role in helping organizations achieve their sustainability objectives. Manufacturers are likely to respond by developing more energy-efficient models and promoting features that support eco-friendly practices, thereby further driving growth in the portable scanner market.

Growing Need for Document Digitization

The increasing emphasis on digitization across various sectors is significantly impacting the portable scanner market. Organizations are recognizing the importance of converting physical documents into digital formats to improve accessibility, storage, and security. This trend is particularly pronounced in industries such as healthcare, legal, and finance, where document management is critical. As of November 2025, the portable scanner market is projected to benefit from this growing need, with an estimated market value reaching $1.5 billion by 2026. The ability to quickly scan and store documents digitally not only enhances operational efficiency but also supports compliance with regulatory requirements. This shift towards digitization is likely to continue driving demand for portable scanners, as businesses seek to streamline their processes and reduce reliance on paper-based documentation.

Rising Adoption of Remote Work Solutions

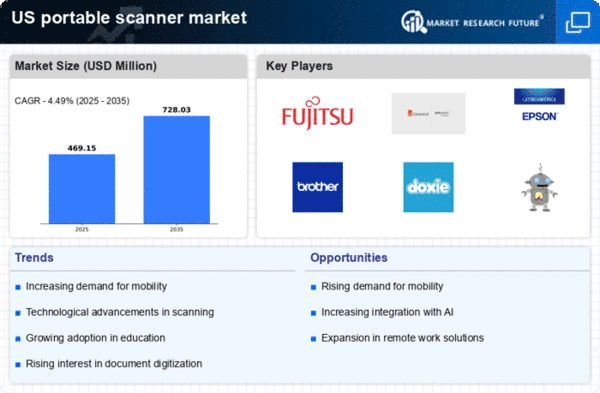

The shift towards remote work has catalyzed the growth of the portable scanner market. As businesses adapt to flexible work environments, employees increasingly require tools that facilitate document management from various locations. Portable scanners enable users to digitize documents quickly and efficiently, which is essential for maintaining productivity outside traditional office settings. According to recent data, the portable scanner market is projected to grow at a CAGR of approximately 8% over the next five years, driven by this trend. The convenience of scanning documents on-the-go aligns with the needs of remote workers, making portable scanners a vital component of modern work solutions. This trend indicates a sustained demand for portable scanning technology, as organizations seek to enhance operational efficiency and streamline workflows in a remote work context.

Expansion of E-commerce and Online Services

The rapid expansion of e-commerce and online services is significantly influencing the portable scanner market. As businesses increasingly operate in digital environments, the need for efficient document handling and management becomes paramount. Portable scanners are essential tools for e-commerce businesses, enabling them to digitize invoices, receipts, and other critical documents swiftly. This trend is particularly relevant in November 2025, as the e-commerce sector continues to thrive, with projections indicating a growth rate of 10% annually. The ability to quickly scan and upload documents enhances operational efficiency and supports seamless transactions in the online marketplace. Consequently, the portable scanner market is likely to experience sustained growth as e-commerce businesses seek reliable solutions for their document management needs.

Technological Advancements in Scanning Solutions

The portable scanner market is experiencing a surge in innovation, with manufacturers integrating advanced technologies into their products. Features such as wireless connectivity, high-resolution imaging, and OCR (Optical Character Recognition) capabilities are becoming standard in new models. These advancements not only improve the functionality of portable scanners but also enhance user experience by allowing seamless integration with various devices and cloud services. As of November 2025, the market is witnessing a notable increase in demand for scanners that offer these sophisticated features, which are essential for both personal and professional use. The incorporation of AI-driven functionalities further positions portable scanners as indispensable tools in document management, thereby driving growth in the portable scanner market. This trend suggests that consumers are increasingly prioritizing technology that enhances efficiency and productivity.