Growing Environmental Awareness

The plastic rigid-ibc market is also influenced by growing environmental awareness among consumers and businesses alike. As sustainability becomes a priority, companies are increasingly seeking eco-friendly packaging solutions. The recyclability of plastic rigid ibcs, along with their potential for reuse, positions them favorably in the eyes of environmentally conscious consumers. This shift is prompting manufacturers to innovate and develop more sustainable products, which could lead to a broader acceptance of plastic rigid ibcs in various sectors. The market is likely to witness a transformation as companies align their packaging strategies with sustainability goals, potentially increasing the market share of eco-friendly options within the plastic rigid-ibc market.

Increased Focus on Supply Chain Efficiency

In the current landscape, the plastic rigid-ibc market is being propelled by an increased focus on supply chain efficiency. Companies are recognizing the importance of optimizing their logistics and distribution processes to reduce costs and improve service levels. The use of plastic rigid ibcs allows for better space utilization in transportation and storage, which can lead to a reduction in overall operational costs. Furthermore, these containers are designed for easy handling and stacking, which enhances warehouse efficiency. As businesses strive to streamline their operations, the plastic rigid-ibc market is projected to see sustained growth, with estimates suggesting a market value of over $1.5 billion by 2026.

Rising Demand for Bulk Packaging Solutions

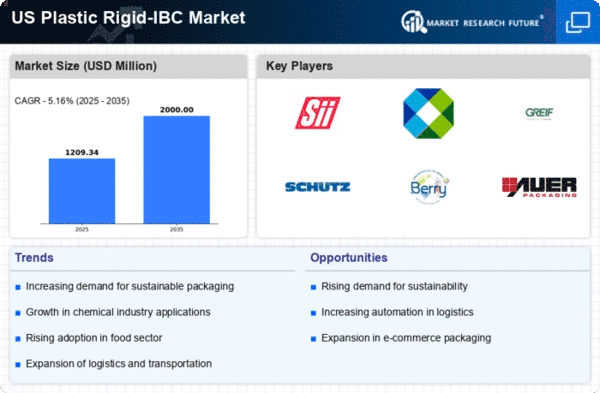

The plastic rigid-ibc market is experiencing a notable increase in demand for bulk packaging solutions across various industries, including chemicals, food and beverage, and pharmaceuticals. This trend is driven by the need for efficient storage and transportation of large quantities of liquids and granulated materials. In 2025, the market is projected to grow at a CAGR of approximately 5.2%, reflecting the growing preference for plastic rigid intermediate bulk containers over traditional packaging methods. The lightweight nature and durability of these containers contribute to their appeal, as they reduce shipping costs and minimize the risk of product contamination. As industries continue to seek cost-effective and reliable packaging solutions, the plastic rigid-ibc market will benefit significantly from this rising demand.

Technological Innovations in Manufacturing

Technological innovations in manufacturing processes are playing a crucial role in shaping the plastic rigid-ibc market. Advances in production techniques, such as blow molding and injection molding, have led to the creation of more durable and lightweight containers. These innovations not only enhance the performance of plastic rigid ibcs but also reduce production costs, making them more accessible to a wider range of industries. Additionally, the integration of smart technologies, such as RFID tracking, is improving inventory management and supply chain visibility. As manufacturers continue to adopt these technologies, the plastic rigid-ibc market is expected to expand, with a projected growth rate of around 4.8% annually over the next few years.

Regulatory Changes and Compliance Requirements

the plastic rigid-ibc market is greatly influenced by regulatory changes and compliance requirements imposed by various governing bodies. These regulations often pertain to safety standards, material specifications, and environmental considerations. As industries face stricter compliance mandates, the demand for high-quality, compliant plastic rigid ibcs is likely to increase. Companies are compelled to invest in containers that meet these regulations to avoid penalties and ensure product safety. This trend is expected to drive growth in the plastic rigid-ibc market, as businesses prioritize compliance in their packaging choices. The market could see an increase in value, potentially reaching $1.2 billion by 2027, as companies adapt to evolving regulatory landscapes.