Regulatory Framework Enhancements

The regulatory landscape for personalized medicine is evolving, with enhancements aimed at facilitating the approval of innovative therapies. The US Food and Drug Administration (FDA) has implemented streamlined processes for the review of personalized medicine products, which is likely to accelerate market growth. These regulatory improvements are designed to encourage the development of novel therapies that cater to specific patient populations. As a result, the personalized medicine market is expected to benefit from a more favorable environment for innovation, potentially leading to a wider array of treatment options for patients. This proactive regulatory approach may also enhance investor confidence, further stimulating growth in the sector.

Growing Demand for Targeted Therapies

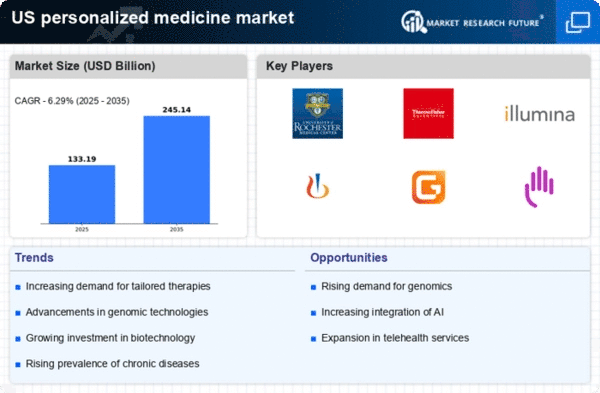

The increasing prevalence of chronic diseases in the US has led to a growing demand for targeted therapies, which are a hallmark of the personalized medicine market. As healthcare providers seek more effective treatment options, the market is projected to reach approximately $2.5 billion by 2026. This demand is driven by the need for therapies that are tailored to individual patient profiles, enhancing treatment efficacy and minimizing adverse effects. The shift towards precision medicine is evident, as healthcare systems recognize the potential for improved patient outcomes. Furthermore, the rise in patient awareness regarding personalized treatment options is likely to propel market growth, as individuals increasingly seek therapies that align with their unique genetic makeup.

Rising Adoption of Companion Diagnostics

The adoption of companion diagnostics is becoming increasingly prevalent in the personalized medicine market. These diagnostic tests are designed to identify patients who are most likely to benefit from specific therapies, thereby optimizing treatment outcomes. The market for companion diagnostics is projected to grow significantly, with estimates suggesting a CAGR of approximately 15% through 2028. This growth is attributed to the increasing number of targeted therapies entering the market, which necessitate the use of companion diagnostics to ensure appropriate patient selection. As healthcare providers embrace these tools, the personalized medicine market is expected to expand, driven by improved patient outcomes and more efficient use of healthcare resources.

Technological Innovations in Diagnostics

Technological advancements in diagnostic tools are significantly impacting the personalized medicine market. Innovations such as next-generation sequencing (NGS) and advanced biomarker identification techniques are enabling more precise patient stratification. These technologies facilitate the development of tailored treatment plans, which are essential for the effective management of diseases. The US market for diagnostic tools is expected to grow at a CAGR of around 10% through 2027, reflecting the increasing integration of these technologies in clinical practice. As diagnostic capabilities improve, healthcare providers can offer more personalized treatment options, thereby enhancing the overall effectiveness of therapies and contributing to the expansion of the personalized medicine market.

Increased Investment in Research and Development

Investment in research and development (R&D) within the personalized medicine market is on the rise, driven by both public and private sectors. The US government has allocated substantial funding for initiatives aimed at advancing precision medicine, with the National Institutes of Health (NIH) investing over $1 billion annually in related research. This influx of capital is fostering innovation and accelerating the development of new therapies tailored to individual genetic profiles. As R&D efforts intensify, the market is likely to witness the introduction of novel treatments that address unmet medical needs, thereby enhancing the overall landscape of personalized medicine.