Rise of Electric and Autonomous Vehicles

The rise of electric and autonomous vehicles is reshaping the landscape of the passenger car-sensors market. As automakers transition towards electric vehicles (EVs) and explore autonomous driving technologies, the demand for sophisticated sensor systems is increasing. These vehicles require advanced sensors for navigation, obstacle detection, and real-time data processing. In 2025, it is estimated that the market for sensors in electric and autonomous vehicles will account for over 40% of the total passenger car-sensors market. This trend indicates a significant shift in automotive technology, as manufacturers prioritize the integration of advanced sensors to enhance the functionality and safety of their vehicles.

Consumer Demand for Enhanced Vehicle Features

There is a growing consumer demand for enhanced vehicle features, which is significantly influencing the passenger car-sensors market. As consumers become more aware of the benefits of advanced safety and convenience features, they are increasingly seeking vehicles equipped with state-of-the-art sensor technologies. Features such as adaptive cruise control, parking assistance, and blind-spot detection are becoming standard expectations rather than optional extras. Market Research Future indicates that nearly 70% of consumers prioritize safety features when purchasing a vehicle, which is likely to drive manufacturers to invest in advanced sensor technologies. This shift in consumer preferences is expected to contribute to a robust growth trajectory for the passenger car-sensors market.

Regulatory Push for Enhanced Safety Standards

Regulatory bodies in the US are increasingly mandating higher safety standards for vehicles, which is significantly impacting the passenger car-sensors market. The National Highway Traffic Safety Administration (NHTSA) has proposed regulations that require advanced safety features, including collision avoidance systems and lane-keeping assistance. These regulations are expected to drive the adoption of various sensors, as manufacturers strive to comply with new safety requirements. By 2026, it is anticipated that over 60% of new vehicles will be equipped with advanced sensor systems, reflecting a substantial increase in market demand. This regulatory push not only enhances vehicle safety but also propels growth in the passenger car-sensors market.

Technological Advancements in Sensor Technology

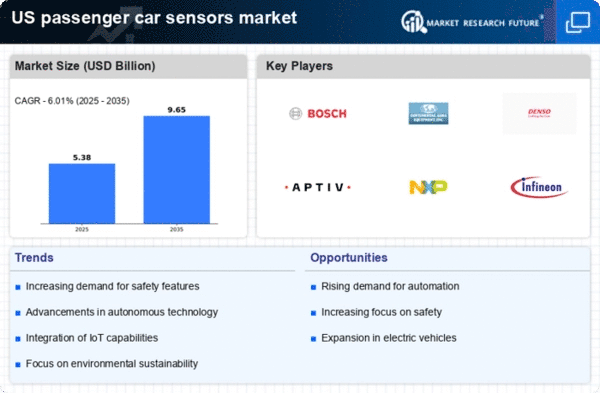

The passenger car-sensors market is experiencing a surge due to rapid technological advancements in sensor technology. Innovations such as LiDAR, radar, and camera systems are enhancing vehicle safety and performance. These technologies are becoming increasingly sophisticated, allowing for improved object detection and environmental awareness. In 2025, the market for advanced sensors is projected to reach approximately $10 billion, reflecting a growth rate of around 15% annually. This growth is driven by the demand for enhanced safety features and the integration of autonomous driving capabilities. As manufacturers invest in research and development, the passenger car-sensors market is likely to expand, offering new opportunities for both established players and new entrants.

Increased Investment in Smart Mobility Solutions

Investment in smart mobility solutions is driving growth in the passenger car-sensors market. As cities evolve and the demand for efficient transportation solutions rises, there is a notable shift towards smart mobility initiatives. These initiatives often incorporate advanced sensor technologies to improve traffic management, reduce congestion, and enhance overall safety. Public and private sectors are collaborating to develop smart infrastructure that supports connected vehicles, which in turn increases the need for sophisticated sensors. By 2027, the investment in smart mobility solutions is projected to exceed $50 billion, indicating a robust growth potential for the passenger car-sensors market as it aligns with broader urban mobility trends.