Increased Investment in Renewable Energy

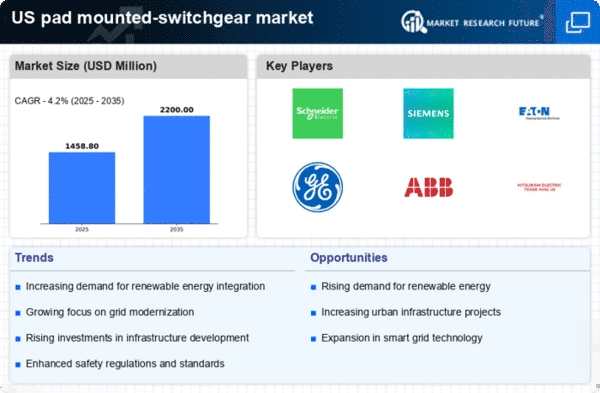

The shift towards renewable energy sources is significantly influencing the pad mounted-switchgear market. As the US government and private sector invest heavily in solar, wind, and other renewable energy projects, the need for efficient power management systems becomes critical. Pad mounted-switchgear plays a vital role in connecting renewable energy sources to the grid, ensuring that power is distributed effectively. The market is witnessing a surge in demand as utilities seek to modernize their infrastructure to accommodate these new energy sources. Reports indicate that investments in renewable energy are expected to reach $100 billion annually by 2030, which will likely drive the growth of the pad mounted-switchgear market as utilities upgrade their systems to handle increased loads and variable energy inputs.

Regulatory Compliance and Safety Standards

the pad mounted-switchgear market is driven by stringent regulatory compliance and safety standards imposed by federal and state authorities.. These regulations are designed to ensure the safe operation of electrical systems, particularly in urban environments where the risk of outages and accidents is heightened. Compliance with these standards often necessitates the adoption of advanced switchgear solutions that can withstand harsh conditions and provide reliable service. As a result, manufacturers are increasingly focusing on developing products that meet or exceed these regulatory requirements. The market is projected to see a steady increase in demand as utilities and commercial entities prioritize safety and compliance, with an estimated growth rate of 4.5% in the coming years as they invest in modern switchgear technologies.

Urbanization and Infrastructure Development

Urbanization is a critical factor driving the pad mounted-switchgear market, particularly in the context of infrastructure development in the US. As cities expand and populations grow, the demand for reliable electrical infrastructure becomes paramount. New residential and commercial developments require efficient power distribution systems, and pad mounted-switchgear offers a compact solution that meets these needs. The market is likely to experience growth as municipalities and developers invest in modern electrical systems to support urban expansion. Current projections suggest that the pad mounted-switchgear market could see an increase in demand of around 5.5% annually, as urban planners recognize the importance of integrating advanced power distribution technologies into new infrastructure projects.

Rising Demand for Reliable Power Distribution

The increasing need for reliable power distribution systems is a primary driver for the pad mounted-switchgear market. As urbanization accelerates in the US, the demand for efficient electrical infrastructure grows. This trend is particularly evident in metropolitan areas where the population density necessitates robust power solutions. the pad mounted-switchgear market is expected to benefit from this demand. These systems provide a compact and reliable means of distributing electricity.. According to recent estimates, the market is projected to grow at a CAGR of approximately 5.2% over the next five years, reflecting the urgency for dependable power distribution solutions. Furthermore, the integration of smart grid technologies is likely to enhance the functionality of pad mounted-switchgear, making it an attractive option for utility companies aiming to improve service reliability.

Technological Integration and Smart Grid Development

The ongoing integration of technology into electrical distribution systems is a significant driver for the pad mounted-switchgear market. The development of smart grids, which utilize advanced communication and automation technologies, is reshaping how electricity is managed and distributed. Pad mounted-switchgear is becoming increasingly sophisticated, incorporating features such as remote monitoring and control capabilities. This technological evolution not only enhances operational efficiency but also improves the reliability of power supply. As utilities in the US continue to invest in smart grid initiatives, the demand for advanced pad mounted-switchgear solutions is expected to rise. Analysts predict that the market could expand by approximately 6% over the next few years, driven by the need for enhanced grid resilience and operational efficiency.