E-commerce Growth and Packaging Adaptation

The rapid expansion of e-commerce is reshaping the packaging machinery market. As online shopping continues to gain traction, businesses are adapting their packaging strategies to meet the demands of shipping and delivery. This shift necessitates the development of packaging solutions that are not only protective but also cost-effective. In 2025, e-commerce sales in the US are projected to reach over $1 trillion, significantly impacting the types of packaging machinery required. Companies are increasingly investing in machinery that can produce packaging tailored for e-commerce, such as lightweight and customizable options. This trend highlights the need for flexibility in packaging machinery, as businesses strive to optimize their supply chains and enhance customer satisfaction through efficient packaging solutions.

Increased Demand for Convenience Packaging

The growing consumer preference for convenience-oriented products is driving the packaging machinery market. As lifestyles become busier, consumers increasingly seek ready-to-eat and easy-to-use products. This trend necessitates advanced packaging solutions that enhance product shelf life and ease of use. In 2025, the convenience food sector is projected to account for approximately 30% of the total food market in the US, thereby propelling the demand for innovative packaging machinery. Manufacturers are investing in technologies that facilitate quick and efficient packaging processes, ensuring that products meet consumer expectations for convenience. This shift not only influences the types of machinery being developed but also encourages the adoption of flexible packaging solutions that can accommodate various product sizes and shapes.

Regulatory Compliance and Safety Standards

The packaging machinery market is significantly influenced by stringent regulatory requirements and safety standards imposed by government agencies. In the US, regulations regarding food safety, environmental impact, and worker safety are becoming increasingly rigorous. Compliance with these regulations necessitates the adoption of advanced packaging technologies that ensure product integrity and safety. For instance, the Food and Drug Administration (FDA) mandates specific labeling and packaging standards for food products, which in turn drives the need for machinery that can meet these requirements. As a result, manufacturers are compelled to invest in packaging machinery that not only adheres to these regulations but also enhances operational efficiency. This focus on compliance is likely to shape the future landscape of the packaging machinery market, as companies strive to avoid penalties and maintain consumer trust.

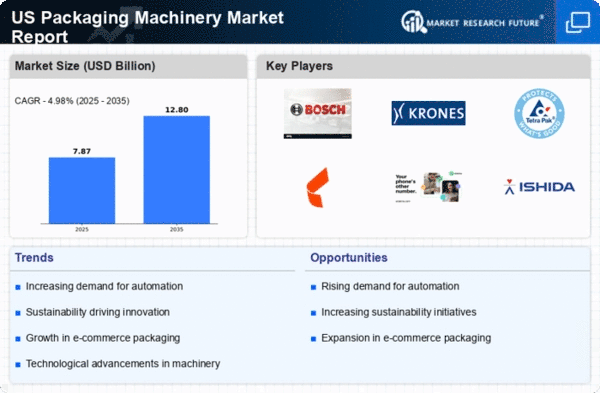

Technological Advancements in Packaging Solutions

Technological innovation plays a pivotal role in shaping the packaging machinery market. The introduction of advanced materials and automation technologies is revolutionizing the industry. For instance, the integration of robotics and artificial intelligence in packaging processes is enhancing efficiency and precision. In 2025, it is estimated that the market for automated packaging machinery will grow by approximately 15%, reflecting the increasing reliance on technology to streamline operations. Additionally, advancements in materials science are leading to the development of lighter, more durable packaging options that reduce waste and improve sustainability. As companies seek to differentiate their products in a competitive market, the demand for cutting-edge packaging machinery that incorporates these technologies is expected to rise, driving growth in the sector.

Sustainability Initiatives and Eco-friendly Packaging

Sustainability is becoming a central focus in the packaging machinery market. As consumers become more environmentally conscious, companies are under pressure to adopt eco-friendly packaging solutions. This trend is prompting manufacturers to invest in machinery that can produce biodegradable and recyclable packaging materials. In 2025, it is anticipated that the market for sustainable packaging will grow by approximately 20%, reflecting the increasing demand for environmentally responsible products. Companies are exploring innovative materials and processes that minimize environmental impact while maintaining product quality. This shift towards sustainability not only influences the types of machinery being developed but also encourages collaboration between packaging manufacturers and material suppliers to create effective eco-friendly solutions.