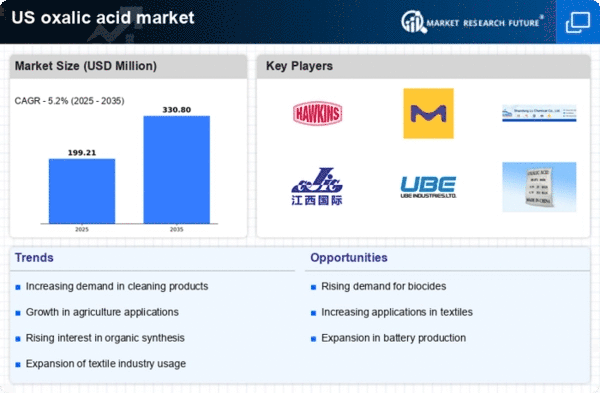

The oxalic acid market exhibits a competitive landscape characterized by a blend of established players and emerging companies, driven by increasing demand across various applications, including pharmaceuticals, textiles, and metal processing. Key players such as Hawkins Inc (US), Merck KGaA (DE), and Shandong Sanyuan Chemical Co Ltd (CN) are strategically positioned to leverage their operational strengths. Hawkins Inc (US) focuses on expanding its production capabilities, while Merck KGaA (DE) emphasizes innovation in product development. Shandong Sanyuan Chemical Co Ltd (CN) appears to be enhancing its market presence through strategic partnerships, collectively shaping a competitive environment that is increasingly dynamic and responsive to market needs.The business tactics employed by these companies include localizing manufacturing and optimizing supply chains to enhance efficiency and reduce costs. The market structure is moderately fragmented, with several players vying for market share. This fragmentation allows for a diverse range of products and services, although the influence of key players remains significant in setting industry standards and driving technological advancements.

In October Hawkins Inc (US) announced the expansion of its production facility in Ohio, aimed at increasing its output capacity by 30%. This strategic move is likely to enhance its competitive edge by meeting the growing demand for oxalic acid in the North American market. The expansion not only signifies a commitment to local manufacturing but also positions Hawkins Inc to respond swiftly to customer needs, thereby strengthening its market position.

In September Merck KGaA (DE) launched a new line of high-purity oxalic acid products tailored for the electronics industry. This initiative underscores the company's focus on innovation and its intent to cater to niche markets that require specialized chemical solutions. By diversifying its product offerings, Merck KGaA is likely to capture a larger share of the market, particularly in sectors that prioritize quality and precision.

In August Shandong Sanyuan Chemical Co Ltd (CN) entered into a strategic partnership with a leading European chemical distributor to enhance its distribution network in Europe. This collaboration is expected to facilitate greater market penetration and improve supply chain efficiencies, allowing Shandong Sanyuan to better serve its European clientele. Such strategic alliances are indicative of a broader trend towards globalization in the chemical sector, where companies seek to expand their reach and operational capabilities.

As of November the competitive trends in the oxalic acid market are increasingly defined by digitalization, sustainability, and the integration of AI technologies. Companies are forming strategic alliances to enhance their operational efficiencies and market reach. The shift from price-based competition to a focus on innovation, technology, and supply chain reliability is becoming more pronounced. This evolution suggests that future competitive differentiation will hinge on the ability to adapt to changing market dynamics and consumer preferences, emphasizing the importance of agility and responsiveness in a rapidly evolving landscape.