Investment in Fleet Modernization

The offshore supply-vessels market is witnessing a trend towards fleet modernization as operators seek to enhance operational efficiency and reduce environmental impact. Many companies are investing in newer, more efficient vessels that comply with the latest environmental regulations. This modernization effort is driven by the need to reduce operational costs and improve competitiveness in a challenging market. Reports indicate that investments in fleet upgrades could reach upwards of $1 billion annually in the coming years. Additionally, modern vessels equipped with advanced technologies are better suited to meet the demands of evolving offshore operations, thereby positioning operators favorably within the offshore supply-vessels market.

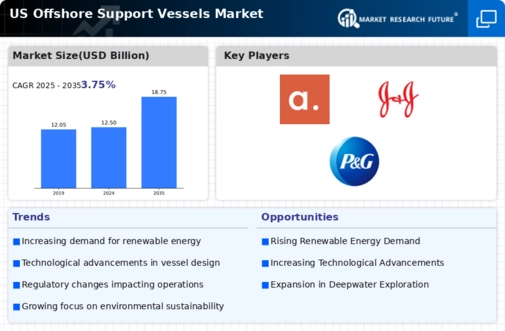

Increasing Demand for Renewable Energy

The offshore supply-vessels market is experiencing a notable surge in demand due to the growing focus on renewable energy sources, particularly offshore wind farms. As the U.S. government aims to achieve 30 GW of offshore wind capacity by 2030, the need for specialized vessels to support installation and maintenance operations is becoming critical. This shift towards renewable energy is expected to drive investments in the offshore supply-vessels market, with projections indicating a potential market growth of over 15% annually. The increasing number of offshore projects necessitates a robust fleet of supply vessels, which are essential for transporting equipment and personnel to remote sites, thereby enhancing operational efficiency and safety in the offshore sector.

Regulatory Compliance and Safety Standards

The offshore supply-vessels market is significantly influenced by stringent regulatory compliance and safety standards imposed by U.S. maritime authorities. These regulations are designed to ensure the safety of personnel and the environment during offshore operations. As a result, vessel operators are compelled to invest in modernizing their fleets to meet these standards, which may include retrofitting existing vessels or acquiring new ones equipped with advanced safety features. The financial implications of compliance can be substantial, with estimates suggesting that operators may need to allocate up to 20% of their operational budgets towards meeting these regulatory requirements. Consequently, this driver is likely to shape the operational landscape of the offshore supply-vessels market.

Technological Integration in Vessel Operations

The integration of advanced technologies in vessel operations is transforming the offshore supply-vessels market. Innovations such as automation, real-time data analytics, and enhanced navigation systems are being adopted to improve operational efficiency and reduce costs. For instance, the implementation of autonomous vessels is projected to reduce operational costs by up to 30%, thereby attracting more investments into the sector. Furthermore, the use of digital platforms for fleet management is becoming increasingly prevalent, allowing operators to optimize routes and minimize fuel consumption. This technological evolution not only enhances the competitiveness of the offshore supply-vessels market but also aligns with the industry's push towards sustainability and efficiency.

Expansion of Oil and Gas Exploration Activities

The offshore supply-vessels market is poised for growth due to the expansion of oil and gas exploration activities in U.S. waters. With the resurgence of interest in offshore drilling, particularly in the Gulf of Mexico, there is an increasing demand for supply vessels to support exploration and production operations. The U.S. Energy Information Administration (EIA) projects that offshore production could account for approximately 15% of total U.S. crude oil production by 2026. This anticipated growth in exploration activities necessitates a reliable fleet of offshore supply vessels, which are essential for transporting equipment, supplies, and personnel to and from offshore platforms, thereby driving market demand.