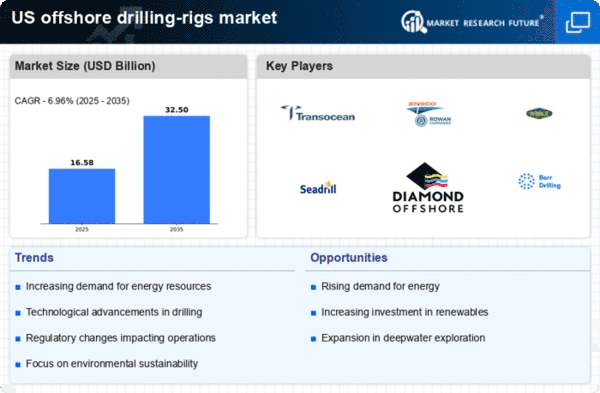

Rising Energy Demand

The increasing demand for energy in the United States is a primary driver for the offshore drilling-rigs market. As the population grows and industrial activities expand, the need for oil and natural gas escalates. According to the U.S. Energy Information Administration, energy consumption is projected to rise by approximately 10% by 2030. This surge in demand necessitates the exploration and extraction of hydrocarbons from offshore reserves, thereby propelling investments in drilling technologies and infrastructure. The offshore drilling-rigs market is likely to benefit from this trend, as companies seek to enhance their production capabilities to meet the growing energy needs of the nation.

Technological Innovations in Drilling

Technological advancements play a crucial role in shaping the offshore drilling-rigs market. Innovations such as automated drilling systems, advanced seismic imaging, and real-time data analytics enhance operational efficiency and safety. These technologies reduce drilling costs and improve recovery rates, making offshore projects more economically viable. The U.S. offshore drilling sector has seen a significant increase in the adoption of these technologies, with estimates suggesting that operational costs could decrease by up to 20% through improved efficiencies. This trend is likely to attract further investments and drive growth in the offshore drilling-rigs market.

Environmental Regulations and Compliance

The offshore drilling-rigs market is significantly influenced by environmental regulations aimed at minimizing ecological impacts. The U.S. government has implemented stringent policies to ensure that offshore drilling activities adhere to environmental standards. Compliance with these regulations often requires companies to invest in advanced technologies and practices that mitigate environmental risks. While this may increase operational costs initially, it also fosters innovation and can lead to long-term sustainability. The market is likely to see a shift towards more environmentally responsible drilling practices, which could enhance the reputation and competitiveness of compliant companies.

Geopolitical Stability and Energy Security

Geopolitical factors play a pivotal role in the offshore drilling-rigs market, particularly concerning energy security. The U.S. aims to reduce its dependence on foreign oil, which drives the need for domestic offshore drilling operations. Political stability in key oil-producing regions can influence global oil prices and, consequently, the profitability of offshore drilling ventures. The U.S. government’s focus on energy independence is likely to bolster investments in offshore drilling infrastructure, as companies seek to capitalize on domestic resources. This trend may lead to increased exploration activities and a more robust offshore drilling-rigs market.

Investment in Renewable Energy Integration

The offshore drilling-rigs market is experiencing a shift towards integrating renewable energy sources with traditional oil and gas operations. As the U.S. government emphasizes a transition to cleaner energy, many offshore drilling companies are exploring hybrid models that combine fossil fuel extraction with renewable energy generation, such as wind and solar. This strategic pivot not only aligns with environmental regulations but also opens new revenue streams. The investment in such technologies is expected to reach billions of dollars, indicating a robust market potential for companies that adapt to this evolving landscape.