Aging Population

The demographic shift towards an aging population in the United States significantly impacts the nutraceuticals market. As the baby boomer generation ages, there is a growing demand for products that support health and longevity. Older adults are increasingly seeking nutraceuticals to manage age-related health issues, such as joint pain, cognitive decline, and cardiovascular health. This demographic is projected to drive the market, as they are more likely to invest in health supplements. By 2030, it is estimated that nearly 20% of the U.S. population will be over 65 years old, creating a substantial market opportunity for nutraceuticals that cater to this age group. The aging population is thus a crucial driver of growth in the nutraceuticals market.

Growing Health Consciousness

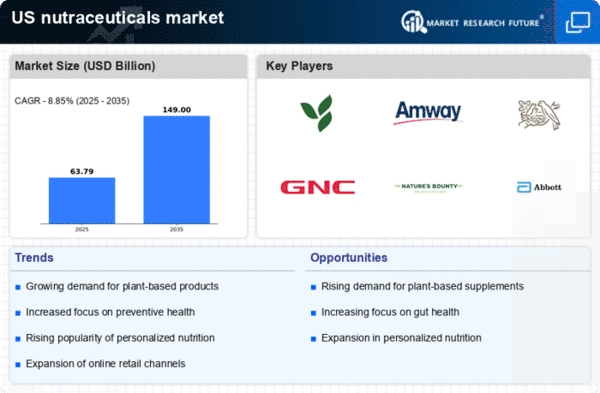

The increasing awareness of health and wellness among consumers is a primary driver of the nutraceuticals market. As individuals become more informed about the benefits of nutrition and dietary supplements, they are more likely to seek out products that promote health. This trend is reflected in the market, where the demand for nutraceuticals has surged, with the market projected to reach approximately $300 billion by 2025. Consumers are increasingly prioritizing preventive healthcare, leading to a rise in the consumption of vitamins, minerals, and herbal supplements. This shift in consumer behavior is likely to continue, as more people recognize the importance of maintaining a healthy lifestyle, thereby propelling the growth of the nutraceuticals market.

Rise of E-commerce Platforms

The expansion of e-commerce platforms is transforming the way consumers access nutraceuticals, serving as a significant driver for the nutraceuticals market. Online shopping offers convenience and a wider selection of products, allowing consumers to easily compare options and read reviews. This shift has been accelerated by advancements in technology and changes in consumer shopping behavior. In 2025, it is estimated that online sales of nutraceuticals will account for over 30% of total sales in the market. E-commerce not only facilitates access to a diverse range of products but also enables companies to reach a broader audience, thus enhancing market growth. The rise of e-commerce platforms is likely to continue influencing the nutraceuticals market positively.

Innovations in Product Formulation

Innovations in product formulation are driving advancements in the nutraceuticals market. Companies are increasingly investing in research and development to create new and effective formulations that cater to evolving consumer preferences. This includes the development of enhanced delivery systems, such as gummies, powders, and liquid forms, which appeal to a broader audience. Additionally, the incorporation of functional ingredients, such as probiotics and adaptogens, is becoming more prevalent. These innovations not only improve product efficacy but also enhance consumer experience. As the market continues to evolve, the emphasis on innovative formulations is likely to play a crucial role in shaping the future of the nutraceuticals market.

Increased Focus on Preventive Healthcare

The growing emphasis on preventive healthcare is a notable driver of the nutraceuticals market. Consumers are increasingly recognizing the importance of maintaining health and preventing diseases rather than solely treating them. This shift in mindset is leading to a higher demand for nutraceuticals that support immune function, digestive health, and overall well-being. The market is responding to this trend, with a variety of products being developed to meet consumer needs. In 2025, the preventive healthcare segment is expected to account for a significant share of the nutraceuticals market, reflecting the changing attitudes towards health management. This focus on prevention is likely to sustain the growth trajectory of the nutraceuticals market.