Supportive Regulatory Environment

The supportive regulatory environment in the United States is a significant driver for the US Nucleic Acid Based Therapeutics Market. The Food and Drug Administration (FDA) has established frameworks to expedite the approval of innovative therapies, including nucleic acid-based treatments. Initiatives such as the Breakthrough Therapy Designation and the Orphan Drug Act are designed to encourage the development of therapies for rare diseases. This regulatory support not only accelerates the time to market for new therapies but also provides financial incentives for developers. As a result, the market is likely to see an influx of new nucleic acid-based therapeutics, enhancing treatment options for patients.

Increased Investment in Biotechnology

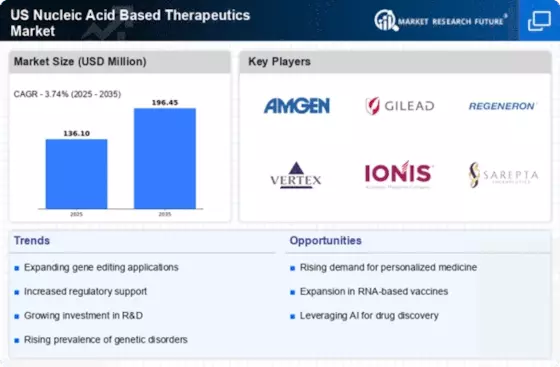

Investment in biotechnology is a key driver for the US Nucleic Acid Based Therapeutics Market. Venture capital funding and public-private partnerships are on the rise, with billions of dollars being allocated to research and development of nucleic acid therapies. In 2025, the biotechnology sector attracted over $50 billion in investments, reflecting a robust interest in innovative therapeutic approaches. This influx of capital is facilitating the development of novel therapies, including RNA-based treatments and gene therapies, which are gaining traction in clinical trials. As funding continues to flow into this sector, it is likely to accelerate the pace of innovation and commercialization of nucleic acid-based therapeutics.

Growing Prevalence of Genetic Disorders

The US Nucleic Acid Based Therapeutics Market is experiencing growth due to the increasing prevalence of genetic disorders. Conditions such as cystic fibrosis, hemophilia, and muscular dystrophy are becoming more common, leading to a heightened demand for targeted therapies. According to the National Institutes of Health, approximately 1 in 10 Americans are affected by a genetic disorder, which underscores the urgent need for innovative treatments. This rising incidence is prompting pharmaceutical companies to invest in nucleic acid-based therapies, as they offer the potential for more effective and personalized treatment options. The market is projected to expand significantly as healthcare providers seek to address these complex conditions with advanced therapeutic solutions.

Technological Advancements in Delivery Systems

Technological advancements in delivery systems are significantly influencing the US Nucleic Acid Based Therapeutics Market. Innovations such as lipid nanoparticles and viral vectors are enhancing the efficacy and safety of nucleic acid therapies. These delivery systems are crucial for ensuring that therapeutic agents reach their intended targets within the body. For instance, the successful use of lipid nanoparticles in mRNA vaccines has demonstrated the potential of these technologies in delivering nucleic acid-based therapies. As research continues to evolve, it is anticipated that more efficient and targeted delivery mechanisms will emerge, further propelling the growth of the market.

Rising Awareness and Acceptance of Gene Therapies

Rising awareness and acceptance of gene therapies are contributing to the expansion of the US Nucleic Acid Based Therapeutics Market. As patients and healthcare providers become more informed about the benefits of gene therapies, there is a growing willingness to explore these options for treatment. Educational initiatives and advocacy groups are playing a pivotal role in disseminating information about the potential of nucleic acid-based therapies. This shift in perception is likely to lead to increased patient demand and, consequently, a larger market for these innovative treatments. The acceptance of gene therapies is expected to grow as more successful case studies emerge, showcasing their effectiveness in treating previously untreatable conditions.