Growing Geriatric Population

The aging population in the US is a significant factor influencing the neuropathic pain market. As individuals age, they become more susceptible to various neuropathic conditions, including diabetic neuropathy and post-surgical pain. The US Census Bureau projects that by 2030, approximately 20% of the population will be aged 65 and older, which correlates with an increased prevalence of neuropathic pain. This demographic shift is likely to drive demand for effective pain management solutions, thereby expanding the neuropathic pain market. Healthcare systems will need to adapt to this growing need, potentially leading to increased investment in research and treatment options tailored for older adults.

Increased Awareness and Diagnosis

There is a notable increase in awareness regarding neuropathic pain and its associated conditions among both healthcare professionals and the general public. Enhanced education and training for clinicians have led to improved diagnostic capabilities, allowing for earlier identification of neuropathic pain. This trend is crucial as timely diagnosis can significantly impact treatment outcomes. The neuropathic pain market benefits from this heightened awareness, as more patients seek medical attention for their symptoms. Furthermore, the implementation of standardized diagnostic criteria has facilitated better recognition of neuropathic pain, potentially increasing the market size as more individuals are diagnosed and treated.

Regulatory Support for Pain Management

Regulatory bodies in the US are increasingly recognizing the importance of effective pain management, which is positively impacting the neuropathic pain market. Initiatives aimed at improving access to pain relief therapies, including streamlined approval processes for new medications, are being implemented. The Food and Drug Administration (FDA) has been actively involved in promoting research and development of innovative pain management solutions. This regulatory support is likely to enhance the availability of effective treatments for neuropathic pain, thereby fostering market growth. As regulations evolve to support better pain management practices, the neuropathic pain market is expected to benefit from increased investment and innovation.

Advancements in Pharmaceutical Research

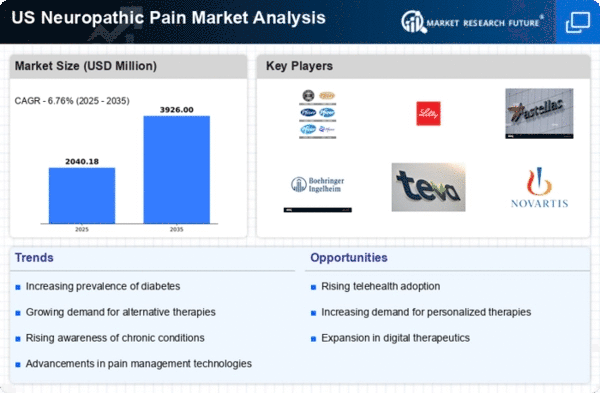

Ongoing advancements in pharmaceutical research are driving innovation within the neuropathic pain market. The development of new analgesics, including novel classes of medications such as cannabinoids and gene therapies, is expanding treatment options for patients. Recent studies indicate that the neuropathic pain market could reach a valuation of approximately $5 billion by 2027, driven by these innovative therapies. Additionally, the focus on understanding the underlying mechanisms of neuropathic pain is likely to yield more effective treatments, further stimulating market growth. As pharmaceutical companies invest in research and development, the landscape of available therapies is expected to evolve, providing patients with more choices.

Rising Prevalence of Neuropathic Disorders

The increasing incidence of neuropathic disorders in the US is a primary driver for the neuropathic pain market. Conditions such as diabetic neuropathy, postherpetic neuralgia, and multiple sclerosis are becoming more common, affecting millions of individuals. According to recent estimates, approximately 7-10% of the US population suffers from neuropathic pain, which translates to around 20 million people. This growing patient population necessitates the development and availability of effective treatment options, thereby propelling the neuropathic pain market forward. As healthcare providers seek to address this rising demand, the industry is likely to witness significant growth in both pharmaceutical and non-pharmaceutical interventions, including novel analgesics and alternative therapies.