Integration of Advanced Analytics

The integration of advanced analytics into network management is emerging as a key driver in the network function-virtualization market. Organizations are increasingly recognizing the value of data-driven decision-making in optimizing network performance. By utilizing analytics tools, companies can gain insights into network traffic patterns, identify potential bottlenecks, and enhance overall efficiency. This trend is particularly relevant as the volume of data generated continues to rise. The network function-virtualization market is likely to see increased adoption of analytics-driven solutions, which can provide organizations with a competitive edge by enabling proactive network management and improved service delivery.

Growing Demand for Network Scalability

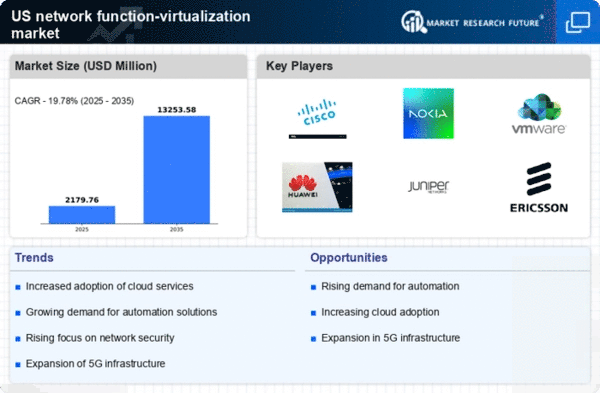

The network function-virtualization market is experiencing a surge in demand for scalable network solutions. As organizations expand their operations, the need for flexible and scalable network architectures becomes paramount. This trend is driven by the increasing volume of data traffic and the necessity for efficient resource allocation. According to recent estimates, the market is projected to grow at a CAGR of approximately 25% over the next five years. Companies are seeking to implement virtualization technologies that allow for rapid scaling of network resources without significant capital expenditure. This shift towards scalable solutions is likely to enhance operational efficiency and reduce downtime, thereby driving growth in the network function-virtualization market.

Cost Efficiency and Operational Savings

Cost efficiency remains a critical driver in the network function-virtualization market. Organizations are increasingly adopting virtualization technologies to reduce operational costs associated with traditional hardware-based networking. By leveraging software-defined networking and virtualization, companies can minimize hardware investments and maintenance expenses. Reports indicate that businesses can achieve savings of up to 30% in operational costs by transitioning to virtualized network functions. This financial incentive is compelling, particularly for small to medium-sized enterprises that may have limited budgets. As organizations continue to seek ways to optimize their expenditures, the network function-virtualization market is likely to benefit from this trend towards cost-effective solutions.

Regulatory Compliance and Standardization

The network function-virtualization market is influenced by the need for regulatory compliance and standardization across various industries. As organizations face increasing scrutiny from regulatory bodies, the demand for compliant network solutions is on the rise. Virtualization technologies can facilitate adherence to industry standards by providing enhanced visibility and control over network operations. For instance, sectors such as finance and healthcare are particularly sensitive to compliance issues, prompting a shift towards virtualized solutions that can ensure data integrity and security. This focus on compliance is expected to drive growth in the network function-virtualization market as organizations seek to mitigate risks associated with non-compliance.

Rising Demand for Enhanced Network Security

Enhanced network security is a pivotal driver in the network function-virtualization market. As cyber threats become more sophisticated, organizations are prioritizing the implementation of robust security measures within their network infrastructures. Virtualization technologies offer the ability to integrate security functions directly into the network, providing a more comprehensive approach to threat management. The market is witnessing a growing trend towards solutions that combine network functions with security capabilities, such as firewalls and intrusion detection systems. This convergence is expected to bolster the network function-virtualization market, as organizations seek to protect their assets while maintaining operational efficiency.