Rising Incidence of Nematode Infestations

The US Nematicides Market is witnessing an increase in the prevalence of nematode infestations, which poses a significant threat to crop production. Nematodes are known to cause substantial yield losses, particularly in high-value crops such as tomatoes and potatoes. Recent studies indicate that nematode-related crop losses can reach up to 20% in some regions, prompting farmers to seek effective nematicide solutions. This rising incidence of infestations is likely to drive demand for nematicides, as farmers aim to protect their investments and ensure food security. Consequently, the US Nematicides Market is expected to expand as agricultural stakeholders prioritize nematode management strategies to mitigate these challenges.

Increasing Demand for Sustainable Agriculture

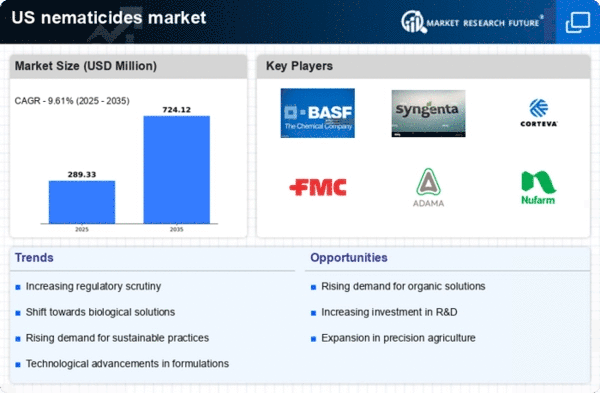

The US Nematicides Market is experiencing a notable shift towards sustainable agricultural practices. Farmers are increasingly seeking nematicides that align with environmentally friendly methods, driven by consumer demand for organic produce. This trend is reflected in the growing market for biopesticides, which are perceived as safer alternatives to traditional chemical nematicides. According to recent data, the biopesticide segment is projected to grow at a compound annual growth rate of over 15% in the coming years. This shift not only addresses environmental concerns but also enhances soil health, thereby potentially increasing crop yields. As sustainability becomes a priority, the US Nematicides Market is likely to adapt, focusing on innovative solutions that meet both agricultural productivity and ecological balance.

Growing Awareness of Soil Health and Fertility

There is a burgeoning awareness among farmers regarding the importance of soil health and fertility, which is influencing the US Nematicides Market. Healthy soil is essential for sustainable crop production, and nematodes can severely impact soil quality. As farmers become more educated about the relationship between soil health and nematode management, they are increasingly investing in nematicides that not only control pests but also enhance soil vitality. This trend is supported by research indicating that certain nematicides can improve soil microbial activity, leading to better nutrient availability for crops. Consequently, the US Nematicides Market is likely to experience growth as farmers prioritize products that contribute to long-term soil health.

Technological Innovations in Nematicide Formulations

Technological advancements are playing a crucial role in shaping the US Nematicides Market. Innovations in formulation technologies, such as nano-encapsulation and controlled-release systems, are enhancing the efficacy and longevity of nematicides. These advancements allow for targeted application, reducing the overall quantity of chemicals needed and minimizing environmental impact. Furthermore, the integration of precision agriculture technologies enables farmers to apply nematicides more efficiently, optimizing their use based on real-time data. This not only improves pest control but also contributes to cost savings for farmers. As these technologies continue to evolve, they are expected to drive growth in the US Nematicides Market, making it more competitive and sustainable.

Regulatory Support for Advanced Pest Management Solutions

The US Nematicides Market is benefiting from regulatory frameworks that support the development and use of advanced pest management solutions. Recent initiatives by government agencies aim to promote the adoption of safer and more effective nematicides, particularly those that comply with stringent environmental standards. This regulatory support encourages research and development in the sector, leading to the introduction of innovative products that meet both efficacy and safety requirements. As regulations evolve, the US Nematicides Market is likely to see an influx of new formulations that cater to the changing needs of farmers while ensuring compliance with environmental guidelines.