Expansion of Over-the-Counter Products

The nasal drug-delivery market is benefiting from the expansion of over-the-counter (OTC) products, which are becoming increasingly available to consumers. This trend is largely attributed to the growing awareness of self-medication and the convenience of accessing nasal formulations without a prescription. OTC nasal sprays for allergy relief and congestion are particularly popular, contributing to the overall growth of the market. Recent data indicates that the OTC segment of the nasal drug-delivery market is expected to account for nearly 40% of total market revenue by 2025. This shift not only enhances consumer access to nasal therapies but also encourages manufacturers to innovate and diversify their product offerings, thereby stimulating competition and growth within the nasal drug-delivery market.

Emerging Trends in Personalized Medicine

The nasal drug-delivery market is increasingly influenced by emerging trends in personalized medicine. As healthcare shifts towards more tailored treatment approaches, the potential for personalized nasal drug formulations is gaining traction. This trend is particularly relevant for conditions such as chronic pain and neurological disorders, where individualized dosing can significantly enhance treatment outcomes. The integration of biomarker-driven therapies into nasal delivery systems may lead to more effective and targeted treatments. Furthermore, the nasal drug-delivery market could see a rise in collaborations between pharmaceutical companies and technology firms to develop smart delivery systems that adapt to individual patient needs. This evolution may position the nasal drug-delivery market as a key player in the broader landscape of personalized healthcare.

Increased Focus on Biologics and Vaccines

The nasal drug-delivery market is witnessing a surge in interest surrounding biologics and vaccines. The ability to deliver large molecules through the nasal route is becoming increasingly recognized as a viable option. This is particularly relevant in the context of vaccine development, where nasal delivery can facilitate mucosal immunity and potentially improve patient compliance. The market for nasal vaccines is expected to reach approximately $1.5 billion by 2026, reflecting a growing recognition of the benefits of this delivery method. Furthermore, the nasal drug-delivery market is likely to benefit from advancements in formulation technologies that enhance the stability and bioavailability of biologics, thereby expanding the range of therapeutics that can be effectively administered nasally.

Growing Investment in Research and Development

Investment in research and development within the nasal drug-delivery market is on the rise, driven by the need for innovative solutions to meet patient needs. Pharmaceutical companies are increasingly allocating resources to explore new formulations and delivery systems that enhance the therapeutic potential of nasal drugs. This trend is supported by government initiatives aimed at fostering innovation in drug delivery technologies. For instance, funding programs have been established to support the development of novel nasal formulations, which could lead to breakthroughs in the treatment of various conditions. As a result, the nasal drug-delivery market is expected to see a significant influx of new products and technologies, potentially increasing its market value to over $5 billion by 2027.

Rising Demand for Non-Invasive Delivery Methods

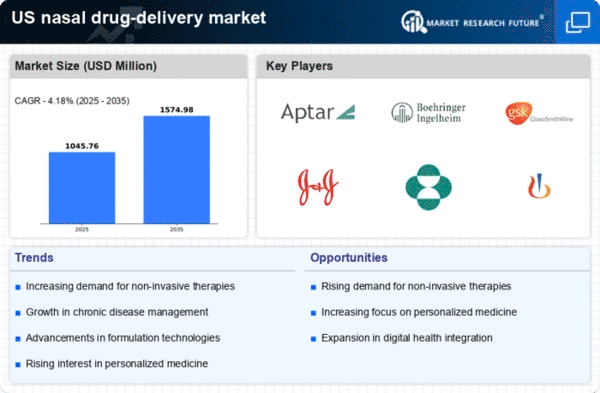

The nasal drug-delivery market is experiencing a notable increase in demand for non-invasive delivery methods. Patients are increasingly seeking alternatives to injections and oral medications due to the discomfort and complications associated with these methods. Nasal delivery offers a convenient and pain-free option, which is particularly appealing for chronic conditions requiring frequent medication. According to recent estimates, the nasal drug-delivery market is projected to grow at a CAGR of approximately 8% over the next five years. This growth is driven by the rising prevalence of respiratory diseases and the need for rapid onset of action in drug therapies. As a result, pharmaceutical companies are investing in research and development to enhance the efficacy and safety of nasal formulations, further propelling the nasal drug-delivery market forward.