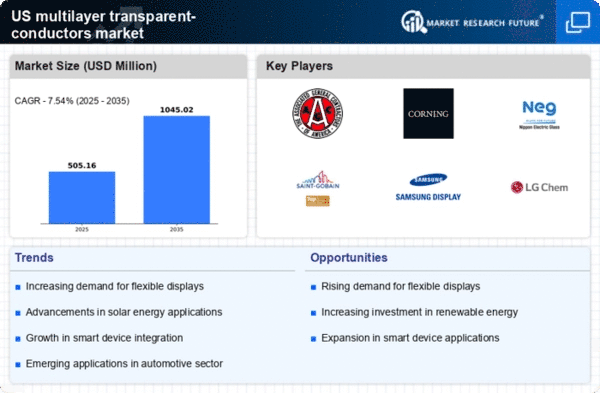

Emergence of Flexible Electronics

Growth is occurring due to the emergence of flexible electronics, which require lightweight and transparent materials for various applications. Flexible displays, wearable devices, and other innovative technologies are driving the demand for multilayer transparent conductors. The flexible electronics market in the US is anticipated to reach $50 billion by 2025, indicating a strong trend towards adaptable and portable technology. This shift towards flexible electronics is likely to create new opportunities for the multilayer transparent-conductors market, as manufacturers develop products that cater to this evolving landscape.

Surge in Electric Vehicle Production

The surge in electric vehicle (EV) production is creating a demand for advanced materials for displays and touch interfaces in the multilayer transparent conductors market. As the automotive industry shifts towards electrification, the demand for high-performance transparent conductors is expected to rise. The US EV market is projected to grow significantly, with sales expected to reach 5 million units by 2025. This growth presents a substantial opportunity for the multilayer transparent-conductors market, as manufacturers seek to provide innovative solutions that enhance the functionality and aesthetics of EVs.

Expansion of Renewable Energy Sources

The expansion of renewable energy sources continues to gain momentum, positioning the multilayer transparent conductors market for growth. Solar energy, in particular, relies heavily on advanced materials for photovoltaic cells, where multilayer transparent conductors play a crucial role in enhancing efficiency. The US solar market is expected to grow at a CAGR of around 20% through 2025, driven by government incentives and a shift towards sustainable energy solutions. This growth in renewable energy adoption is likely to create substantial opportunities for the multilayer transparent-conductors market, as manufacturers seek to develop more efficient and cost-effective solar technologies.

Growing Adoption of Smart Technologies

The multilayer transparent-conductors market is experiencing a surge in demand due to the increasing adoption of smart technologies across various sectors. Smart devices, including smartphones, tablets, and smart home appliances, require advanced display technologies that utilize multilayer transparent conductors. This trend is expected to drive the market as manufacturers seek to enhance device performance and energy efficiency. In 2025, the market for smart devices in the US is projected to reach approximately $200 billion, indicating a robust growth trajectory. As these devices become more prevalent, the multilayer transparent-conductors market is likely to benefit significantly from this technological shift.

Increased Investment in Research and Development

Investment in research and development (R&D) within the multilayer transparent-conductors market is on the rise, as companies strive to innovate and improve product performance. This focus on R&D is essential for developing new materials and technologies that can meet the evolving demands of various applications, including displays and energy generation. In 2025, R&D spending in the US electronics sector is projected to exceed $100 billion, highlighting the commitment to advancing technology. As companies invest in R&D, the multilayer transparent-conductors market is likely to see enhanced product offerings and improved market competitiveness.