Increased Defense Budgets

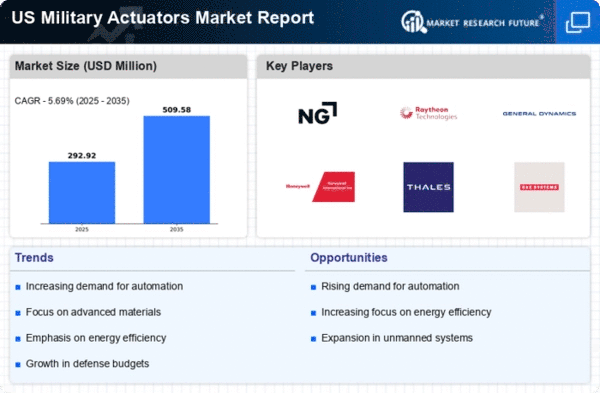

The military actuators market is experiencing growth due to increased defense budgets in the US. The government has allocated substantial funds to modernize military equipment, which includes advanced actuator systems. In 2025, the defense budget is projected to exceed $800 billion, with a significant portion directed towards enhancing operational capabilities. This financial commitment indicates a robust demand for military actuators, as they are integral to various applications, including unmanned systems and weaponry. The focus on upgrading existing platforms and developing new technologies further propels the military actuators market, as these components are essential for improving performance and reliability in critical defense operations.

Advancements in Automation

The military actuators market is significantly influenced by advancements in automation technologies. As military operations increasingly rely on automated systems, the demand for precise and reliable actuators rises. These components are crucial for the functionality of drones, robotic systems, and automated weaponry. In 2025, the market for military automation is expected to grow by approximately 15%, highlighting the increasing integration of actuators in automated platforms. This trend suggests that manufacturers are likely to invest in developing more sophisticated actuator technologies to meet the evolving needs of modern warfare, thereby driving growth in the military actuators market.

Focus on Enhanced Performance

The military actuators market is driven by a focus on enhanced performance and operational efficiency. As military operations become more complex, the need for actuators that can withstand extreme conditions and provide reliable performance is paramount. The demand for high-performance actuators is expected to grow by 10% annually, as military applications require components that can operate effectively in diverse environments. This emphasis on performance encourages manufacturers to innovate and improve actuator designs, ensuring they meet the rigorous standards set by military specifications. Such advancements are likely to bolster the military actuators market as defense contractors seek superior solutions.

Integration of Smart Technologies

The military actuators market is increasingly influenced by the integration of smart technologies, such as IoT and AI. These technologies enhance the functionality of actuators, allowing for real-time monitoring and adaptive control. The incorporation of smart features is projected to increase the efficiency of military systems, with estimates suggesting a potential reduction in operational costs by up to 25%. As the military seeks to leverage these innovations, the demand for smart actuators is expected to rise, driving growth in the military actuators market. This trend indicates a shift towards more intelligent systems that can respond dynamically to changing operational conditions.

Rising Demand for Unmanned Systems

The military actuators market is witnessing a surge in demand for unmanned systems, including drones and autonomous vehicles. These systems require advanced actuators to ensure precise movement and control. The US military's strategic shift towards unmanned operations is evident, with investments projected to reach $20 billion by 2026. This shift not only enhances operational efficiency but also reduces risks to personnel. Consequently, the military actuators market is likely to expand as manufacturers focus on developing specialized actuators tailored for unmanned applications, thereby addressing the unique challenges posed by these technologies.