Expansion of Clinical Applications

The microarray analysis market is witnessing an expansion in clinical applications, which is a key driver of its growth. Microarrays are increasingly utilized in various fields, including oncology, pharmacogenomics, and infectious diseases. The ability to analyze gene expression profiles and identify biomarkers has made microarrays indispensable in personalized medicine. In the US, the adoption of microarray technology in clinical settings has been bolstered by regulatory approvals for diagnostic tests that utilize this technology. For example, the FDA has approved several microarray-based tests for cancer diagnosis and treatment monitoring. This trend indicates a growing acceptance of microarray analysis in clinical practice, which is expected to contribute to a market growth rate of approximately 12% over the next few years.

Advancements in Data Analysis Software

The microarray analysis market is being propelled by advancements in data analysis software, which enhance the interpretation of complex genomic data. As the volume of data generated by microarray experiments increases, the need for sophisticated analytical tools becomes paramount. In the US, software companies are developing innovative solutions that integrate machine learning and artificial intelligence to improve data analysis efficiency. These advancements allow researchers to derive meaningful insights from microarray data more quickly and accurately. The integration of user-friendly interfaces and robust analytical capabilities is likely to attract more researchers to utilize microarray technologies. This trend suggests a potential increase in market growth, with estimates indicating a CAGR of approximately 9% over the next several years.

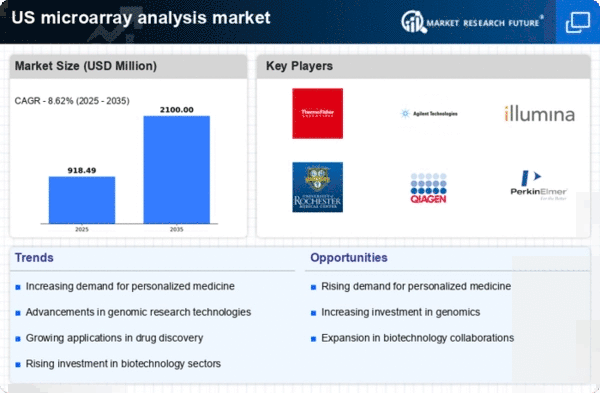

Increasing Investment in Genomic Research

The microarray analysis market is experiencing a surge in investment, particularly in genomic research. This trend is driven by the growing recognition of the importance of genomics in understanding diseases and developing targeted therapies. In the US, funding for genomic research has increased significantly, with federal and private sectors allocating substantial resources. For instance, the National Institutes of Health (NIH) has committed billions of dollars to genomics, which directly benefits the microarray analysis market. This influx of capital is likely to enhance the development of innovative microarray technologies, thereby expanding their applications in clinical diagnostics and research. As a result, the market is poised for growth, with projections indicating a compound annual growth rate (CAGR) of over 10% in the coming years.

Rising Demand for High-Throughput Screening

The microarray analysis market is significantly influenced by the rising demand for high-throughput screening methods. Researchers and pharmaceutical companies are increasingly seeking efficient ways to analyze large volumes of genetic data. Microarrays offer a solution by enabling simultaneous analysis of thousands of genes, which is crucial for drug discovery and development. In the US, the pharmaceutical industry is investing heavily in high-throughput technologies, with estimates suggesting that the market for high-throughput screening could reach $5 billion by 2026. This demand is likely to drive the adoption of microarray technologies, as they provide the necessary throughput and scalability for large-scale studies. Consequently, the microarray analysis market is expected to benefit from this trend, with a projected growth rate of around 11% in the near future.

Growing Focus on Disease Prevention and Management

The microarray analysis market is benefiting from a growing focus on disease prevention and management strategies. As healthcare systems in the US shift towards proactive approaches, the role of microarray technology in identifying genetic predispositions and biomarkers becomes increasingly vital. This shift is reflected in the rising number of research initiatives aimed at understanding the genetic basis of diseases. Furthermore, healthcare providers are increasingly utilizing microarray analysis for early detection and personalized treatment plans. The emphasis on preventive healthcare is likely to drive demand for microarray technologies, as they provide critical insights into individual health risks. This trend may contribute to a market growth rate of around 10% in the coming years, as more healthcare institutions adopt these technologies for improved patient outcomes.