Growth in Chemical Processing

The metering pump market is significantly influenced by the growth in the chemical processing industry. As the demand for specialty chemicals and advanced materials rises, manufacturers increasingly rely on metering pumps for precise dosing and mixing. The chemical processing sector is projected to contribute approximately 35% to the metering pump market by 2025, reflecting the industry's need for accuracy and consistency in production. Furthermore, innovations in pump technology, such as enhanced materials and designs, are likely to improve performance and reliability, thereby fostering further growth in the metering pump market.

Expansion of Oil and Gas Sector

The metering pump market is poised for growth due to the expansion of the oil and gas sector in the US. As exploration and production activities increase, the demand for precise fluid transfer solutions rises correspondingly. Metering pumps play a crucial role in various applications, including chemical injection and fuel transfer, ensuring accurate dosing and minimizing waste. In 2025, the oil and gas industry is expected to represent around 25% of the metering pump market, driven by the need for efficiency and safety in operations. This trend suggests a promising outlook for manufacturers and suppliers within the metering pump market.

Industrial Growth and Automation

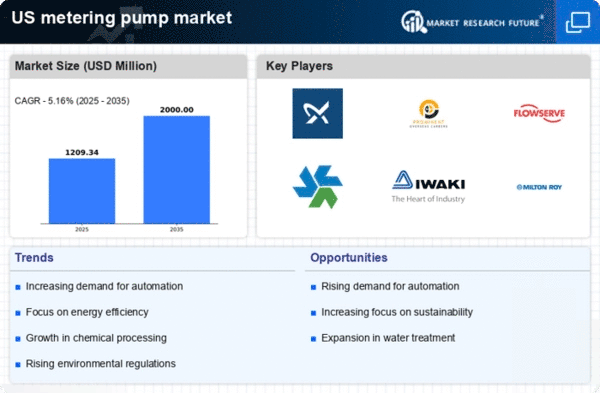

The metering pump market benefits significantly from the ongoing industrial growth and the push towards automation across various sectors. Industries such as chemicals, pharmaceuticals, and food processing increasingly rely on metering pumps for accurate fluid handling. The market is projected to grow at a CAGR of 5% from 2025 to 2030, fueled by the need for enhanced efficiency and reduced operational costs. Automation technologies, including IoT and smart manufacturing, are likely to integrate with metering pumps, providing real-time monitoring and control. This integration not only optimizes production processes but also enhances the overall reliability of the metering pump market.

Rising Demand in Water Treatment

The metering pump market experiences a notable surge in demand due to the increasing need for efficient water treatment solutions. As municipalities and industries strive to meet stringent water quality standards, the adoption of metering pumps becomes essential. These pumps facilitate precise chemical dosing, ensuring optimal treatment processes. In 2025, the water treatment sector is projected to account for approximately 30% of the metering pump market, driven by the necessity for compliance with environmental regulations. The growing awareness of water scarcity and the need for sustainable practices further amplify this trend, indicating a robust future for the metering pump market in the water treatment domain.

Increased Focus on Energy Efficiency

The metering pump market is experiencing a shift towards energy efficiency as industries seek to reduce operational costs and environmental impact. The implementation of energy-efficient metering pumps not only lowers energy consumption but also enhances process reliability. In 2025, it is anticipated that energy-efficient solutions will account for nearly 40% of the metering pump market, driven by both regulatory pressures and corporate sustainability goals. This trend indicates a growing preference for technologies that align with energy conservation efforts, suggesting a transformative phase for the metering pump market.