Evolving Regulatory Environment

The regulatory landscape surrounding genetic testing is evolving, which has implications for the US Mendelian Disorders Testing Market. Recent updates in policies and guidelines from regulatory bodies, such as the Food and Drug Administration (FDA) and the Centers for Medicare & Medicaid Services (CMS), are aimed at ensuring the safety and efficacy of genetic tests. These changes are fostering a more structured environment for the development and commercialization of genetic testing products. As regulations become more defined, companies are likely to invest in research and development to comply with these standards, potentially leading to an influx of innovative testing solutions. This regulatory evolution not only enhances consumer confidence but also encourages healthcare providers to adopt genetic testing as a standard practice, thereby propelling market growth.

Rising Prevalence of Genetic Disorders

The rising prevalence of genetic disorders is a critical driver for the US Mendelian Disorders Testing Market. Recent statistics indicate that approximately 1 in 10 individuals in the US are affected by a genetic condition, underscoring the urgent need for effective testing solutions. This increasing prevalence is prompting healthcare providers to recommend genetic testing more frequently, as it plays a vital role in diagnosis and management. Moreover, the growing recognition of the importance of genetic counseling is contributing to the demand for testing services. As more individuals seek to understand their genetic risks, the market is likely to witness sustained growth. The combination of rising prevalence and increased healthcare provider recommendations is creating a robust environment for the expansion of the US Mendelian Disorders Testing Market.

Increased Investment in Genetic Research

Investment in genetic research is on the rise, significantly impacting the US Mendelian Disorders Testing Market. Public and private funding for genetic research initiatives has surged, with government agencies allocating substantial resources to understand the genetic basis of various disorders. This influx of funding is facilitating the development of advanced testing methodologies and expanding the scope of genetic testing services. For instance, the National Institutes of Health (NIH) has reported a 15% increase in funding for genetic research projects over the past year. Such investments are likely to lead to breakthroughs in the identification and treatment of Mendelian disorders, thereby enhancing the overall market landscape. As research continues to unveil new genetic insights, the demand for comprehensive testing solutions is expected to grow, further driving market expansion.

Technological Advancements in Genetic Testing

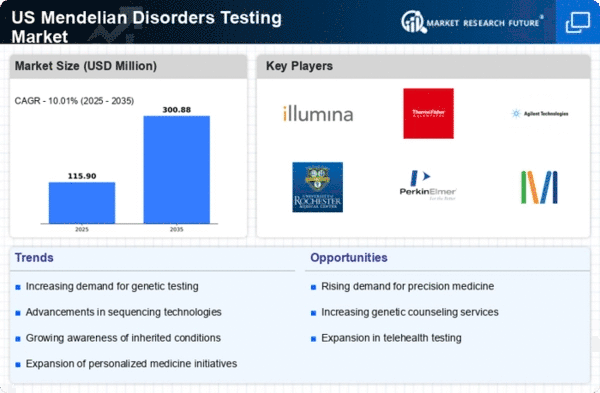

The US Mendelian Disorders Testing Market is experiencing a transformative phase due to rapid technological advancements in genetic testing methodologies. Innovations such as next-generation sequencing (NGS) and whole exome sequencing (WES) have significantly enhanced the accuracy and efficiency of genetic testing. These technologies allow for the simultaneous analysis of multiple genes, which is particularly beneficial for identifying Mendelian disorders. As a result, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 10% over the next five years. Furthermore, the integration of artificial intelligence in data analysis is streamlining the interpretation of complex genetic data, thereby improving diagnostic outcomes. This technological evolution not only facilitates earlier detection of genetic disorders but also supports personalized treatment plans, making it a pivotal driver in the US Mendelian Disorders Testing Market.

Growing Awareness and Demand for Early Diagnosis

There is a notable increase in awareness regarding genetic disorders and the importance of early diagnosis within the US Mendelian Disorders Testing Market. Educational initiatives and advocacy from healthcare professionals have contributed to a heightened understanding of Mendelian disorders among the general public. This growing awareness is leading to an increase in demand for genetic testing services, as individuals seek proactive measures to identify potential genetic risks. According to recent surveys, nearly 60% of respondents expressed a desire for genetic testing to understand their health better. This trend is further supported by the rising prevalence of genetic disorders, which has been estimated to affect approximately 1 in 300 individuals in the US. Consequently, the demand for early diagnosis is driving market growth, as families and individuals prioritize genetic testing to inform healthcare decisions.