Increased Focus on Infection Control

In the US Medical Suction Device Market, there is a growing emphasis on infection control measures. Healthcare facilities are increasingly adopting suction devices that are designed to minimize the risk of cross-contamination and infection transmission. This trend is driven by heightened awareness of healthcare-associated infections (HAIs) and the need for stringent infection control protocols. Manufacturers are responding by developing devices with features such as disposable components and antimicrobial surfaces. The market for infection control-focused suction devices is anticipated to grow significantly, as hospitals and clinics prioritize patient safety and compliance with regulatory standards. This shift is likely to contribute to an increase in the overall market size, reflecting the importance of infection control in healthcare.

Growing Awareness of Patient-Centric Care

The US Medical Suction Device Market is increasingly influenced by the growing awareness of patient-centric care. Healthcare providers are recognizing the importance of tailoring treatment approaches to individual patient needs, which includes the use of medical suction devices. This shift towards personalized care is prompting the development of devices that are more adaptable and user-friendly. As patients become more involved in their own care, the demand for suction devices that can be easily operated at home or in outpatient settings is rising. This trend is expected to drive innovation and competition within the market, as manufacturers strive to create products that align with the principles of patient-centric care.

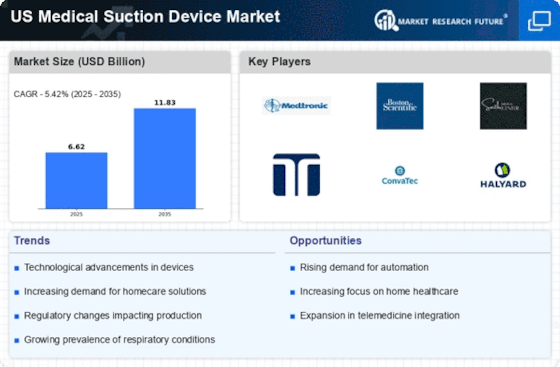

Rising Demand for Home Healthcare Solutions

The US Medical Suction Device Market is witnessing a surge in demand for home healthcare solutions. As the population ages and the prevalence of chronic respiratory conditions rises, more patients are requiring suction devices for home use. This trend is further supported by the increasing preference for at-home care, which is often seen as a more comfortable and cost-effective alternative to hospital stays. The market for home healthcare suction devices is projected to expand, with estimates suggesting a growth rate of around 8% annually over the next few years. This shift towards home healthcare is likely to reshape the landscape of the medical suction device market, as manufacturers adapt their offerings to meet the needs of this emerging segment.

Regulatory Support and Reimbursement Policies

The US Medical Suction Device Market benefits from favorable regulatory support and reimbursement policies. Government initiatives aimed at improving healthcare access and affordability are encouraging the adoption of medical suction devices. The Centers for Medicare & Medicaid Services (CMS) has established reimbursement frameworks that facilitate the coverage of suction devices, thereby incentivizing healthcare providers to invest in these essential tools. This regulatory environment is expected to bolster market growth, as it reduces financial barriers for both providers and patients. Additionally, ongoing efforts to streamline the approval process for new devices are likely to enhance innovation within the market, further driving its expansion.

Technological Advancements in Medical Suction Devices

The US Medical Suction Device Market is experiencing a notable transformation due to rapid technological advancements. Innovations such as portable suction devices and automated systems are enhancing the efficiency and effectiveness of suction procedures. These advancements not only improve patient outcomes but also streamline operations in healthcare settings. The integration of smart technology, including real-time monitoring and data analytics, is becoming increasingly prevalent. This trend is expected to drive market growth, as healthcare providers seek to adopt devices that offer enhanced functionality and ease of use. Furthermore, the market is projected to reach a valuation of approximately USD 1.5 billion by 2026, indicating a robust demand for technologically advanced suction devices.