Rising Labor Costs

This market is being driven by the rising labor costs associated with traditional farming practices. As labor shortages become more pronounced in the agricultural sector, farmers are increasingly turning to mechanized solutions to maintain productivity. Automated irrigation systems reduce the reliance on manual labor, allowing for more efficient water management and crop care. With labor costs projected to rise by 15% over the next five years, the mechanized irrigation market is likely to see heightened demand for technologies that streamline operations and reduce labor dependency. This shift not only addresses economic challenges but also enhances the overall efficiency of agricultural practices.

Rising Water Scarcity

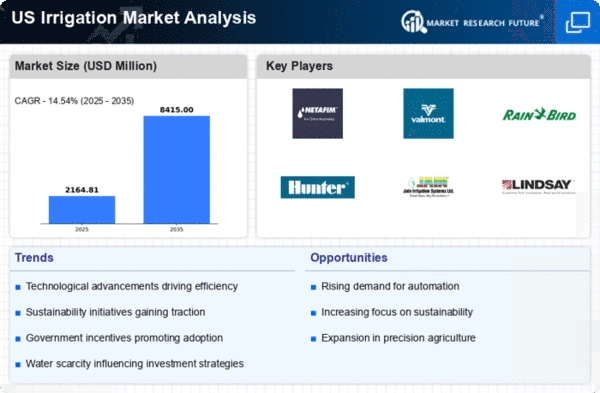

This market is experiencing a notable surge due to increasing water scarcity across various regions in the US. As drought conditions become more prevalent, farmers are compelled to adopt advanced irrigation systems that optimize water usage. Mechanized irrigation technologies, such as drip and sprinkler systems, allow for precise water application, reducing waste and enhancing crop yield. According to recent data, approximately 40% of agricultural water use in the US is attributed to irrigation, highlighting the critical need for efficient water management solutions. This trend is likely to drive investments in mechanized irrigation market technologies, as stakeholders seek to mitigate the impacts of water shortages on agricultural productivity.

Increasing Crop Demand

The mechanized irrigation market is poised for growth due to the rising demand for food crops driven by population growth and changing dietary preferences. As the US population continues to expand, the agricultural sector faces pressure to increase production efficiency. Mechanized irrigation systems play a crucial role in enhancing crop yields and ensuring consistent quality. With projections indicating a 20% increase in food demand by 2030, farmers are likely to invest in mechanized irrigation technologies to meet these challenges. This trend underscores the importance of efficient irrigation practices in the mechanized irrigation market, as stakeholders seek to balance productivity with sustainability.

Environmental Sustainability Initiatives

This market is increasingly shaped by environmental sustainability initiatives aimed at reducing the ecological footprint of agriculture. As awareness of climate change and resource depletion grows, farmers are adopting mechanized irrigation systems that promote sustainable practices. Technologies such as rainwater harvesting and efficient water distribution systems contribute to lower energy consumption and reduced greenhouse gas emissions. Government policies and incentives encouraging sustainable farming practices further bolster the mechanized irrigation market. This alignment with environmental goals is likely to attract investments and foster innovation within the industry, enhancing its long-term viability.

Technological Advancements in Agriculture

The mechanized irrigation market is significantly influenced by rapid technological advancements in agricultural practices. Innovations such as automated irrigation systems, soil moisture sensors, and remote monitoring capabilities are transforming traditional farming methods. These technologies enable farmers to make data-driven decisions, optimizing irrigation schedules and reducing operational costs. The market for precision agriculture is projected to reach $12 billion by 2026, indicating a robust growth trajectory. As farmers increasingly recognize the benefits of mechanized irrigation systems, the demand for these solutions is expected to rise, further propelling the mechanized irrigation market forward.