Surge in Data Traffic

The massive mimo market is experiencing a surge in data traffic, driven by the increasing number of connected devices and the demand for high-bandwidth applications. As consumers and businesses alike rely more on cloud services, video streaming, and IoT devices, the need for robust wireless infrastructure becomes paramount. Reports indicate that mobile data traffic in the US is projected to grow at a CAGR of approximately 30% over the next few years. This growth necessitates the deployment of advanced technologies like massive mimo, which can enhance spectral efficiency and capacity. Consequently, the massive mimo market is likely to expand as telecommunications providers invest in upgrading their networks to accommodate this rising demand.

Growing Adoption of Smart Devices

The growing adoption of smart devices is influencing the massive mimo market, as these devices require reliable and high-speed internet connectivity. The proliferation of smartphones, smart home devices, and wearables is creating an environment where traditional network architectures struggle to keep pace. This trend is prompting network operators to explore massive mimo solutions, which can effectively manage the increased load and provide seamless connectivity. In the US, it is estimated that the number of connected devices will exceed 50 billion by 2030, further emphasizing the need for advanced wireless technologies. Thus, the massive mimo market is likely to see increased demand as operators adapt to this evolving landscape.

Advancements in Wireless Technology

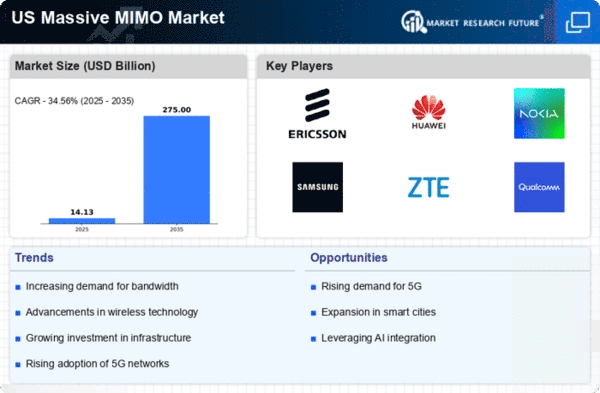

Technological advancements play a crucial role in the massive mimo market, as innovations in wireless communication continue to evolve. The introduction of 5G technology has significantly increased the relevance of massive mimo systems, which utilize multiple antennas to improve signal quality and network capacity. The US is at the forefront of 5G deployment, with major carriers investing billions in infrastructure. It is estimated that the massive mimo market could reach a valuation of over $10 billion by 2026, driven by these advancements. As the industry embraces new standards and protocols, the massive mimo market is poised for substantial growth, enabling faster and more reliable connectivity.

Regulatory Initiatives Promoting Innovation

Regulatory initiatives in the US are fostering innovation within the massive mimo market. Policymakers are recognizing the importance of advanced wireless technologies in driving economic growth and enhancing public safety. Initiatives aimed at streamlining the approval process for new telecommunications infrastructure are encouraging investment in massive mimo systems. Furthermore, the FCC's efforts to allocate spectrum for 5G and beyond are creating a favorable environment for the deployment of massive mimo technologies. As these regulatory frameworks evolve, they are likely to stimulate growth in the massive mimo market, enabling operators to leverage cutting-edge solutions to meet consumer demands.

Increased Investment in Telecommunications Infrastructure

Investment in telecommunications infrastructure is a key driver for the massive mimo market. With the US government and private sector stakeholders prioritizing the expansion of broadband access, significant funding is being allocated to enhance network capabilities. The Federal Communications Commission (FCC) has initiated various programs aimed at improving connectivity in underserved areas, which indirectly boosts the demand for advanced technologies like massive mimo. As a result, the massive mimo market is likely to benefit from this influx of capital, as network operators seek to modernize their systems to meet the growing expectations of consumers and businesses.