Growth of Supply Chain Resilience

In the face of various challenges, the logistics market is increasingly focusing on building supply chain resilience. Companies are recognizing the importance of diversifying their supply sources and enhancing their logistics capabilities to mitigate risks associated with disruptions. This trend is reflected in the growing investment in technology and infrastructure aimed at improving supply chain visibility and flexibility. In 2025, it is estimated that around 40% of logistics market players will prioritize resilience strategies, which may include adopting advanced analytics and real-time tracking systems. Such initiatives are essential for maintaining operational efficiency and ensuring customer satisfaction in a dynamic market environment.

Increased Focus on Data Analytics

Data analytics is becoming a cornerstone of decision-making in the logistics market. Companies are leveraging big data to gain insights into consumer behavior, optimize routes, and enhance inventory management. This trend is driven by the need for greater efficiency and cost-effectiveness in logistics operations. By 2025, it is projected that approximately 35% of logistics market firms will invest in advanced data analytics tools to improve their operational strategies. The ability to analyze and interpret data effectively can lead to more informed decisions, ultimately enhancing service quality and customer satisfaction in the logistics market.

Rising Demand for Last-Mile Delivery

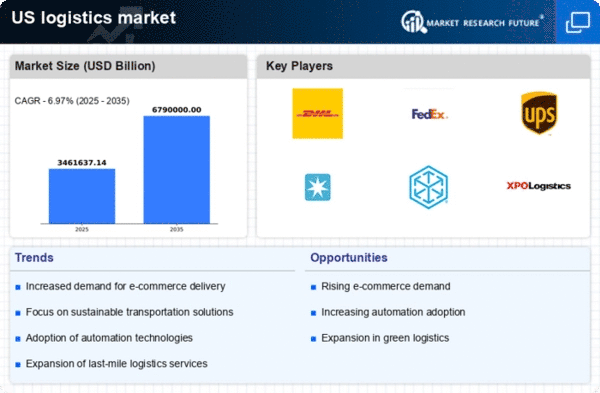

The logistics market is currently experiencing a surge in demand for last-mile delivery services. This trend is driven by the increasing consumer preference for rapid delivery options, particularly in urban areas. As e-commerce continues to expand, companies are investing heavily in optimizing their last-mile logistics to enhance customer satisfaction. In 2025, the last-mile delivery segment is projected to account for approximately 30% of the total logistics market revenue in the US. This shift necessitates innovative solutions, such as the use of drones and autonomous vehicles, to meet consumer expectations while managing costs. The logistics market must adapt to these evolving demands to remain competitive.

Expansion of Green Logistics Practices

The logistics market is increasingly adopting green logistics practices in response to growing environmental concerns. Companies are implementing sustainable practices such as optimizing transportation routes, utilizing eco-friendly packaging, and investing in energy-efficient technologies. This shift is not only beneficial for the environment but also aligns with consumer preferences for sustainable products and services. In 2025, it is estimated that around 20% of logistics market players will prioritize green initiatives, which may lead to reduced operational costs and improved brand reputation. The logistics market must continue to evolve towards sustainability to meet regulatory requirements and consumer expectations.

Technological Advancements in Automation

The logistics market is witnessing a significant transformation due to advancements in automation technologies. Companies are increasingly adopting automated systems for warehousing, inventory management, and transportation to enhance efficiency and reduce operational costs. In 2025, it is anticipated that automation will account for nearly 25% of the logistics market operations in the US. This shift not only streamlines processes but also addresses labor shortages by minimizing the reliance on manual labor. The logistics market must embrace these technological innovations to improve service delivery and maintain a competitive edge in an evolving landscape.