Advancements in Smart Grid Technologies

The integration of smart grid technologies is significantly influencing the US Load Monitoring System Market. As utilities and energy providers invest in modernizing their infrastructure, the demand for load monitoring systems that can seamlessly interface with smart grid solutions is increasing. These systems enable real-time monitoring and management of energy loads, facilitating better demand response strategies and enhancing grid reliability. The US government has allocated substantial funding towards smart grid initiatives, which is expected to further propel the adoption of load monitoring systems. This alignment with smart grid technologies not only enhances operational efficiency but also supports the transition towards renewable energy sources, thereby reinforcing the growth trajectory of the US Load Monitoring System Market.

Growing Adoption of Renewable Energy Sources

The transition towards renewable energy sources is significantly impacting the US Load Monitoring System Market. As more organizations and households invest in solar, wind, and other renewable energy technologies, the need for effective load monitoring systems becomes paramount. These systems facilitate the integration of renewable energy into existing grids by providing real-time data on energy production and consumption. The US government has set ambitious targets for renewable energy adoption, which is likely to drive the demand for load monitoring solutions that can support these initiatives. Consequently, the US Load Monitoring System Market is expected to experience robust growth as stakeholders seek to harness the benefits of renewable energy while ensuring grid stability and efficiency.

Rising Demand for Energy Management Solutions

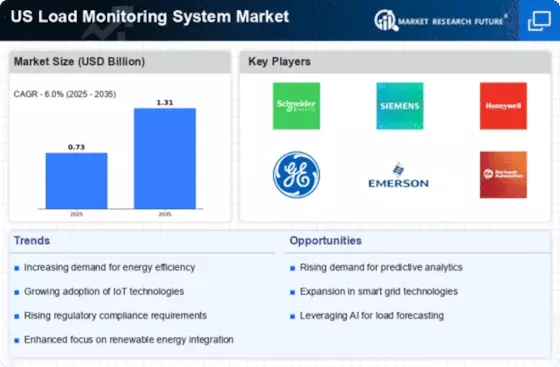

The US Load Monitoring System Market is experiencing a notable surge in demand for energy management solutions. This trend is largely driven by the increasing need for businesses and households to optimize energy consumption and reduce costs. According to recent data, the market for energy management systems is projected to grow at a compound annual growth rate (CAGR) of approximately 15% over the next five years. This growth is indicative of a broader shift towards more efficient energy usage, as organizations seek to implement load monitoring systems that provide real-time insights into energy consumption patterns. Consequently, the US Load Monitoring System Market is poised to benefit from this heightened focus on energy efficiency, as stakeholders recognize the value of data-driven decision-making in managing energy resources.

Technological Innovations in Load Monitoring Solutions

Technological advancements are playing a pivotal role in the evolution of the US Load Monitoring System Market. Innovations such as artificial intelligence, machine learning, and advanced analytics are being integrated into load monitoring systems, enhancing their capabilities and effectiveness. These technologies enable predictive analytics, allowing organizations to anticipate energy demands and optimize resource allocation accordingly. The market is witnessing the emergence of sophisticated solutions that not only monitor energy usage but also provide actionable insights for improving efficiency. As businesses increasingly recognize the potential of these innovations, the demand for advanced load monitoring systems is expected to rise, further propelling the growth of the US Load Monitoring System Market.

Increased Focus on Sustainability and Environmental Regulations

The US Load Monitoring System Market is being shaped by a growing emphasis on sustainability and stringent environmental regulations. As federal and state governments implement policies aimed at reducing carbon emissions, businesses are compelled to adopt load monitoring systems that help track and manage energy usage effectively. For instance, the Environmental Protection Agency (EPA) has introduced various initiatives that encourage the adoption of energy-efficient technologies. This regulatory landscape is fostering a conducive environment for the growth of load monitoring systems, as organizations seek to comply with environmental standards while also achieving operational efficiencies. The alignment of business practices with sustainability goals is likely to drive further investment in the US Load Monitoring System Market.