Rising Healthcare Expenditure

The increase in healthcare expenditure in the US is another critical driver for the liver biopsy market. With healthcare spending projected to reach approximately $6 trillion by 2027, there is a growing investment in diagnostic services, including liver biopsies. This financial commitment from both public and private sectors is likely to enhance access to advanced diagnostic technologies and improve the overall quality of care. Additionally, as more healthcare providers adopt cutting-edge technologies, the liver biopsy market may benefit from increased utilization rates. The correlation between healthcare expenditure and the demand for diagnostic procedures suggests a positive outlook for the liver biopsy market in the coming years.

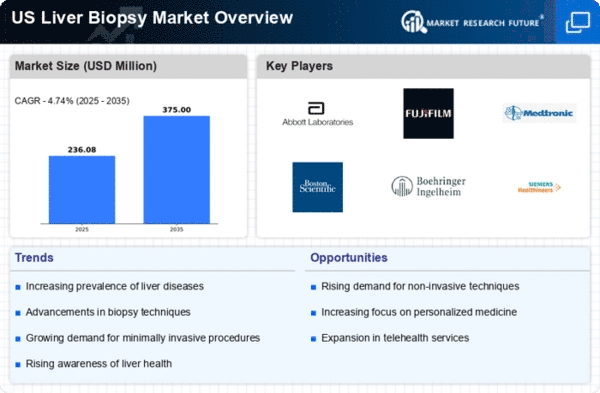

Advancements in Biopsy Techniques

Innovations in biopsy techniques are transforming the landscape of the liver biopsy market. The introduction of minimally invasive procedures, such as ultrasound-guided liver biopsies, has improved patient outcomes and reduced complications. These advancements not only enhance the accuracy of diagnoses but also increase patient comfort, which may lead to a higher acceptance rate of liver biopsies among patients. Moreover, the market is witnessing the development of new technologies, such as liquid biopsies, which could potentially offer less invasive alternatives to traditional methods. As these techniques gain traction, the liver biopsy market is likely to expand, driven by the demand for safer and more effective diagnostic options.

Increasing Awareness of Liver Health

The growing awareness regarding liver health among the population appears to be a significant driver for the liver biopsy market. Educational campaigns and initiatives by healthcare organizations are emphasizing the importance of early detection of liver diseases. This heightened awareness is likely to lead to an increase in the number of individuals seeking diagnostic procedures, including liver biopsies. As a result, the liver biopsy market may experience a surge in demand, particularly among high-risk populations. Furthermore, the prevalence of liver-related conditions, such as non-alcoholic fatty liver disease (NAFLD), is estimated to affect approximately 25% of the US population, which could further stimulate the market as more patients require accurate diagnosis and monitoring through liver biopsy procedures.

Aging Population and Associated Health Issues

The aging population in the US is contributing to the growth of the liver biopsy market. As individuals age, they are more susceptible to various liver diseases, including cirrhosis and liver cancer. This demographic shift is expected to increase the demand for diagnostic procedures, including liver biopsies, as healthcare providers seek to identify and manage liver-related conditions effectively. According to projections, the population aged 65 and older is expected to reach 80 million by 2040, which could significantly impact the liver biopsy market. The need for accurate diagnosis and timely intervention in this age group may drive the market forward, as healthcare systems adapt to the rising prevalence of liver diseases.

Integration of Artificial Intelligence in Diagnostics

The integration of artificial intelligence (AI) in diagnostic processes is emerging as a transformative force in the liver biopsy market. AI technologies are being utilized to enhance the accuracy of liver disease diagnosis and improve the interpretation of biopsy results. By analyzing vast amounts of data, AI can assist healthcare professionals in making more informed decisions regarding patient care. This technological advancement may lead to increased efficiency in the diagnostic process, potentially resulting in a higher volume of liver biopsies performed. As AI continues to evolve and gain acceptance in clinical settings, the liver biopsy market could see substantial growth driven by the demand for more precise and reliable diagnostic tools.