Growing E-commerce Demand

The surge in e-commerce activities has a profound impact on the light commercial-vehicles market. As online shopping continues to expand, businesses require efficient delivery solutions to meet consumer expectations. In 2025, e-commerce sales in the US are projected to reach approximately $1 trillion, necessitating a robust logistics framework. This demand drives the need for light commercial vehicles, which are essential for last-mile delivery. Companies are increasingly investing in their fleets to ensure timely deliveries, thereby propelling growth in the light commercial-vehicles market. The need for versatile vehicles that can navigate urban environments while carrying substantial loads is becoming more pronounced, indicating a shift in purchasing patterns towards vehicles that can accommodate these requirements.

Rising Fuel Prices and Economic Factors

Economic conditions, particularly fuel prices, play a pivotal role in shaping the light commercial-vehicles market. Fluctuations in fuel costs can significantly impact operational expenses for businesses relying on transportation. In 2025, average fuel prices in the US are projected to remain volatile, prompting companies to seek more fuel-efficient vehicles. This economic pressure encourages a shift towards light commercial vehicles that offer better fuel economy, thereby reducing overall costs. Additionally, economic growth and increased consumer spending are likely to drive demand for goods and services, further necessitating efficient logistics solutions. As businesses adapt to these economic realities, the light commercial-vehicles market is expected to evolve, with a focus on cost-effective and fuel-efficient vehicle options.

Urbanization and Infrastructure Development

Urbanization trends in the US are influencing the light commercial-vehicles market significantly. As more people migrate to urban areas, the demand for efficient transportation solutions increases. The US urban population is expected to reach 85% by 2030, leading to heightened requirements for commercial vehicles that can operate effectively in congested city environments. Infrastructure development initiatives, such as improved road networks and dedicated delivery zones, further support this trend. Consequently, businesses are compelled to adapt their logistics strategies, often opting for light commercial vehicles that offer maneuverability and efficiency. This urban-centric approach is likely to shape the future of the light commercial-vehicles market, as companies seek to optimize their operations in densely populated areas.

Technological Advancements in Fleet Management

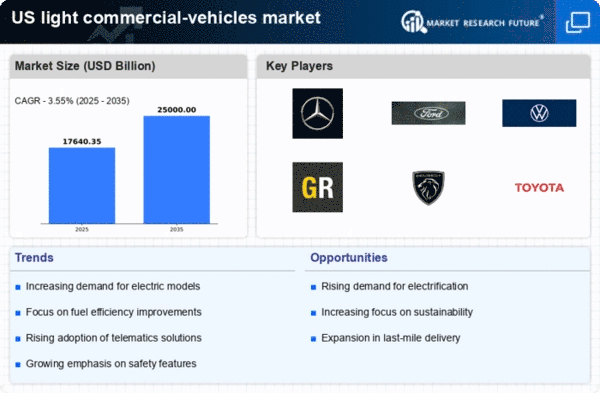

Technological innovations are reshaping the light commercial-vehicles market, particularly in fleet management. The integration of telematics and data analytics allows businesses to optimize their operations, enhancing efficiency and reducing costs. In 2025, it is estimated that over 50% of light commercial vehicles will be equipped with advanced telematics systems. These technologies enable real-time tracking, route optimization, and predictive maintenance, which are crucial for maintaining competitive advantage in a rapidly evolving market. As companies increasingly rely on data-driven decision-making, the demand for technologically advanced light commercial vehicles is expected to rise. This trend not only improves operational efficiency but also contributes to better customer service, thereby reinforcing the importance of technology in the light commercial-vehicles market.

Regulatory Compliance and Sustainability Initiatives

Regulatory frameworks in the US are increasingly emphasizing sustainability, which is influencing the light commercial-vehicles market. Stricter emissions standards and fuel efficiency regulations are prompting companies to transition towards greener vehicle options. The US government has set ambitious targets to reduce greenhouse gas emissions, which could lead to a significant shift in vehicle procurement strategies. In 2025, it is anticipated that around 30% of new light commercial vehicles sold will comply with these enhanced standards. This regulatory environment encourages manufacturers to innovate and develop vehicles that not only meet compliance but also appeal to environmentally conscious consumers. As sustainability becomes a core focus, the light commercial-vehicles market is likely to witness a transformation in vehicle design and technology.