Healthcare Sector Adaptation

The healthcare sector's ongoing adaptation to latex allergy concerns significantly influences the latex allergy market. Hospitals and clinics are increasingly adopting latex-free protocols to protect patients and staff from potential allergic reactions. This shift is reflected in the procurement of latex-free medical supplies, which has been reported to increase by approximately 20% annually. The latex allergy market is thus experiencing a transformation, with manufacturers focusing on producing high-quality, latex-free products to meet the evolving needs of healthcare providers. This trend not only enhances patient safety but also drives innovation within the market.

Consumer Awareness and Education

Consumer awareness and education regarding latex allergies are becoming increasingly vital in driving the latex allergy market. As more individuals become informed about the risks associated with latex exposure, there is a growing demand for latex-free products across various sectors, including personal care and household items. The latex allergy market is likely to benefit from educational campaigns that highlight the importance of recognizing and managing latex allergies. This heightened awareness may lead to a shift in consumer preferences, further propelling the demand for latex-free alternatives and expanding market opportunities.

Legislative and Regulatory Changes

Legislative and regulatory changes play a crucial role in shaping the latex allergy market. The US government has implemented various regulations aimed at ensuring the safety of medical products, which includes mandates for labeling and the use of latex-free alternatives in certain environments. These regulations are expected to bolster the latex allergy market by compelling manufacturers to innovate and comply with safety standards. As a result, the market may witness an influx of new latex-free products, catering to both healthcare and consumer sectors, thereby enhancing overall market growth.

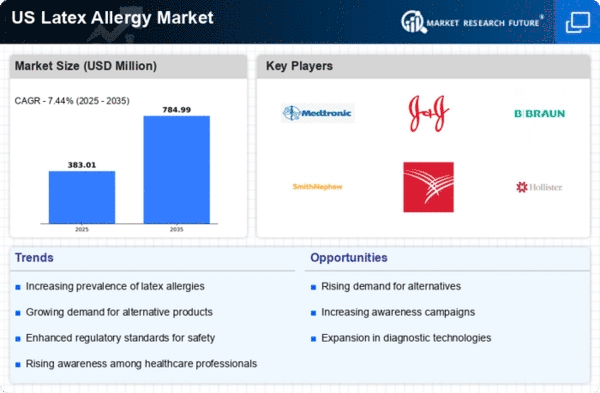

Rising Incidence of Latex Allergies

The increasing prevalence of latex allergies among the population appears to be a primary driver for the latex allergy market. Studies indicate that approximately 1-6% of the general population in the US may be affected by latex allergies, with higher rates observed in healthcare workers and individuals with spina bifida. This growing incidence necessitates the development and availability of latex-free alternatives, thereby expanding the market. The latex allergy market is likely to see a surge in demand for products such as gloves, medical devices, and consumer goods that are free from latex, as individuals seek safer options to avoid allergic reactions.

Technological Advancements in Product Development

Technological advancements in product development are significantly impacting the latex allergy market. Innovations in materials science have led to the creation of high-performance latex-free alternatives that meet or exceed the functionality of traditional latex products. This trend is particularly evident in the medical field, where new materials are being developed for gloves and other medical devices. The latex allergy market is poised for growth as manufacturers leverage these advancements to produce safer, more effective products. As technology continues to evolve, the market may see an increase in the variety and quality of latex-free options available to consumers.