Expansion of 5G Networks

The ongoing expansion of 5G networks in the US is poised to significantly impact the iot chips market. With 5G technology offering enhanced data speeds and lower latency, it enables a new wave of connected devices that require advanced chips. The demand for iot chips is likely to surge as industries such as automotive, healthcare, and smart cities increasingly adopt 5G-enabled solutions. According to industry estimates, the number of connected devices in the US is expected to reach 75 billion by 2025, creating a substantial market for iot chips. This growth is driven by the need for real-time data processing and communication, which 5G facilitates, thereby enhancing the overall functionality of iot devices.

Growing Adoption of Industrial IoT

The industrial sector in the US is rapidly adopting iot technologies to enhance operational efficiency and reduce costs. This trend, known as Industrial IoT (IIoT), is driving the demand for specialized iot chips that can withstand harsh environments and provide reliable connectivity. Industries such as manufacturing, logistics, and energy are integrating iot solutions to monitor equipment, optimize supply chains, and improve safety. The iot chips market is expected to benefit from this shift, with projections indicating that IIoT applications could account for over 30% of the total iot chips market by 2027. This growth underscores the importance of robust and efficient chip solutions in industrial applications.

Emergence of Edge Computing Solutions

The emergence of edge computing is reshaping the landscape of the iot chips market. By processing data closer to the source, edge computing reduces latency and bandwidth usage, which is particularly beneficial for real-time applications. This shift is likely to increase the demand for specialized iot chips designed for edge devices, as they need to handle complex computations locally. Industries such as healthcare, automotive, and manufacturing are increasingly adopting edge computing to enhance their iot solutions. The market for edge computing is projected to grow at a CAGR of 30% through 2028, indicating a substantial opportunity for iot chip manufacturers to innovate and cater to this evolving demand.

Increased Investment in Smart Infrastructure

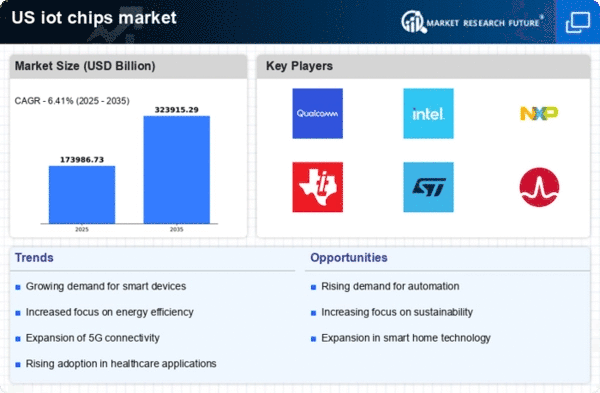

Investment in smart infrastructure across the US is a critical driver for the iot chips market. Government initiatives and private sector investments are focusing on modernizing transportation, energy, and urban development. For instance, the US Department of Transportation has allocated billions for smart city projects, which integrate iot technologies to improve efficiency and sustainability. This trend is likely to create a robust demand for iot chips, as they are essential components in smart sensors, traffic management systems, and energy monitoring solutions. The market for iot chips is projected to grow at a CAGR of 20% through 2026, reflecting the increasing reliance on intelligent infrastructure.

Rising Consumer Awareness of Smart Home Technologies

Consumer awareness and interest in smart home technologies are significantly influencing the iot chips market. As more households in the US adopt smart devices for security, convenience, and energy management, the demand for iot chips is expected to rise. Products such as smart thermostats, security cameras, and home automation systems rely heavily on advanced chip technology to function effectively. Market Research Future suggests that the smart home market could reach $100 billion by 2025, with iot chips playing a crucial role in this expansion. This trend indicates a shift in consumer behavior towards embracing technology that enhances daily living, thereby driving growth in the iot chips market.