Growth in Manufacturing Sector

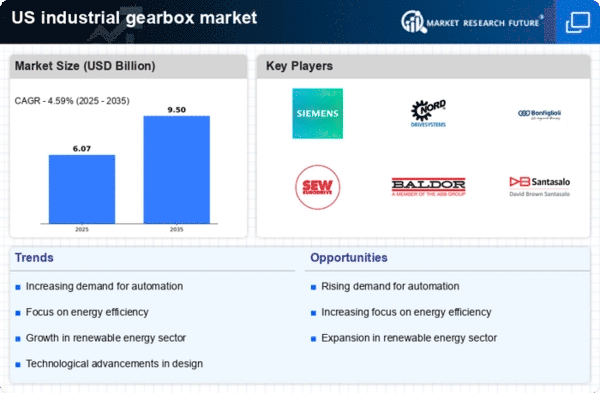

The Industrial Gearbox Service Market is poised for growth, driven by the expansion of the manufacturing sector. As production facilities increase their output to meet rising consumer demand, the need for reliable and efficient gearbox systems becomes paramount. The manufacturing sector has shown resilience, with projections indicating a compound annual growth rate of approximately 4% over the next few years. This growth translates into a higher demand for gearbox services, as manufacturers require regular maintenance and upgrades to ensure optimal performance. Consequently, the Industrial Gearbox Service Market is likely to benefit from this upward trend in manufacturing activities.

Rising Demand for Energy Efficiency

The Industrial Gearbox Service Market is experiencing a notable increase in demand for energy-efficient solutions. As industries strive to reduce operational costs and minimize environmental impact, the focus on energy efficiency has intensified. Gearboxes play a crucial role in energy consumption, and advancements in technology are enabling the development of more efficient designs. According to recent data, energy-efficient gearboxes can reduce energy consumption by up to 30%, which is a compelling incentive for manufacturers. This trend is likely to drive the growth of the Industrial Gearbox Service Market as companies seek to upgrade their systems to meet these efficiency standards.

Expansion of Renewable Energy Sector

The Industrial Gearbox Service Market is benefiting from the expansion of the renewable energy sector. As the world shifts towards sustainable energy sources, the demand for gearboxes in wind turbines and solar energy systems is increasing. This sector is projected to grow at a compound annual growth rate of over 8% in the coming years, creating a substantial market for gearbox services. The unique requirements of renewable energy applications necessitate specialized gearbox solutions, which in turn drives the need for expert servicing and maintenance. Consequently, the Industrial Gearbox Service Market is likely to see a surge in demand as renewable energy projects proliferate.

Increased Focus on Preventive Maintenance

In the Industrial Gearbox Service Market, there is a growing emphasis on preventive maintenance strategies. Companies are increasingly recognizing the importance of maintaining their equipment to avoid costly downtimes and repairs. Preventive maintenance not only extends the lifespan of gearboxes but also enhances operational efficiency. Data suggests that organizations implementing preventive maintenance can reduce equipment failure rates by up to 50%. This proactive approach is likely to drive demand for specialized gearbox services, as businesses seek to implement comprehensive maintenance programs that ensure their systems remain in peak condition.

Technological Innovations in Gearbox Design

The Industrial Gearbox Service Market is significantly influenced by ongoing technological innovations in gearbox design. The introduction of advanced materials and manufacturing techniques has led to the development of gearboxes that are lighter, stronger, and more efficient. Innovations such as 3D printing and smart sensors are revolutionizing the way gearboxes are designed and maintained. These advancements not only improve performance but also reduce the overall cost of ownership. As industries adopt these new technologies, the demand for specialized services to support these advanced systems is expected to rise, thereby propelling the growth of the Industrial Gearbox Service Market.