Growth in Automation and Robotics

The induction motors market is benefiting from the rapid growth in automation and robotics across various sectors. Industries such as manufacturing, logistics, and agriculture are increasingly integrating automated systems to enhance productivity and reduce labor costs. Induction motors play a crucial role in these systems, powering conveyor belts, robotic arms, and other machinery. The projected market for industrial automation in the US is $200 billion by 2026, reflecting robust demand for induction motors. This trend suggests that as automation continues to expand, the induction motors market will likely see sustained growth, driven by the need for reliable and efficient motor solutions.

Rising Demand for Energy Efficiency

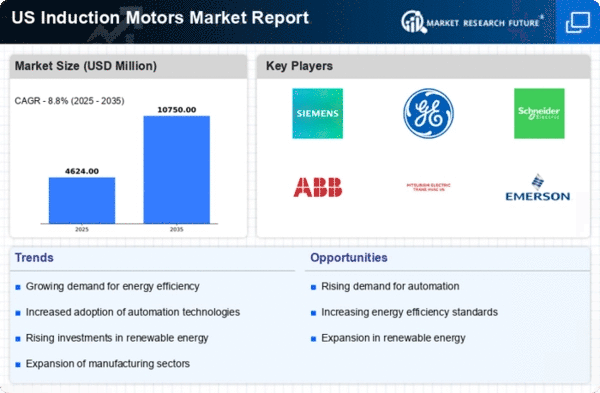

The induction motors market is experiencing a notable surge in demand for energy-efficient solutions. As industries strive to reduce operational costs and comply with stringent energy regulations, the adoption of induction motors, known for their efficiency, is increasing. In the US, energy-efficient motors can reduce energy consumption by up to 30%, which translates to significant savings for businesses. This trend is further supported by government incentives aimed at promoting energy efficiency, thereby driving the induction motors market. The focus on sustainability and reducing carbon footprints is likely to propel the market forward. Companies are seeking to enhance their operational efficiency while minimizing environmental impact.

Technological Innovations in Motor Design

The induction motors market is witnessing a wave of technological innovations that enhance motor performance and reliability. Advances in materials, such as the use of high-efficiency laminations and improved cooling techniques, are contributing to the development of more efficient induction motors. These innovations are crucial as industries seek to optimize their operations and reduce energy consumption. The market for high-efficiency motors in the US is expected to grow by 15% annually, reflecting the increasing preference for advanced motor technologies. This trend suggests that ongoing research and development in motor design will play a pivotal role in shaping the future of the induction motors market.

Increased Focus on Renewable Energy Sources

The induction motors market is likely to benefit from the increased focus on renewable energy sources in the US. As the country aims to transition to cleaner energy, the demand for induction motors in wind and solar energy applications is rising. Induction motors are essential for various processes in renewable energy generation, including the operation of turbines and solar tracking systems. The US renewable energy market is projected to grow at a CAGR of 10% through 2027, which could significantly impact the induction motors market. This trend indicates a growing synergy between renewable energy initiatives and the demand for efficient motor solutions.

Expansion of Electric Vehicle Infrastructure

The induction motors market is poised for growth due to the expansion of electric vehicle (EV) infrastructure in the US. As the automotive industry shifts towards electrification, induction motors are increasingly utilized in electric drivetrains. The US government has set ambitious targets for EV adoption, aiming for 50% of new vehicle sales to be electric by 2030. This transition is expected to create a substantial demand for induction motors, which are favored for their durability and efficiency. The investment in charging stations and related infrastructure is likely to further stimulate the induction motors market, as these motors are integral to the operation of various EV components.