Increasing Cancer Incidence

The rising incidence of cancer in the US is a primary driver for the immunotherapy drugs market. According to the American Cancer Society, approximately 1.9 million new cancer cases are expected to be diagnosed in 2025. This alarming trend necessitates innovative treatment options, with immunotherapy emerging as a promising solution. The effectiveness of immunotherapy in treating various cancers, including melanoma and lung cancer, has garnered significant attention. As healthcare providers seek to improve patient outcomes, the demand for immunotherapy drugs is likely to increase. Furthermore, the growing awareness among patients and healthcare professionals about the benefits of immunotherapy could further propel market growth. The immunotherapy drugs market is thus positioned to expand as it addresses the urgent need for effective cancer treatments.

Regulatory Support and Approvals

Regulatory support plays a crucial role in shaping the immunotherapy drugs market. The US Food and Drug Administration (FDA) has streamlined the approval process for immunotherapy drugs, recognizing their potential to treat various cancers. In recent years, the FDA has granted accelerated approvals for several immunotherapeutic agents, which has encouraged pharmaceutical companies to invest in this area. As of 2025, the number of approved immunotherapy drugs has increased significantly, with over 30 agents currently available on the market. This regulatory environment fosters innovation and encourages the development of new therapies. The immunotherapy drugs market is likely to continue thriving as regulatory bodies remain supportive of advancements that can improve patient outcomes.

Growing Investment in Biotechnology

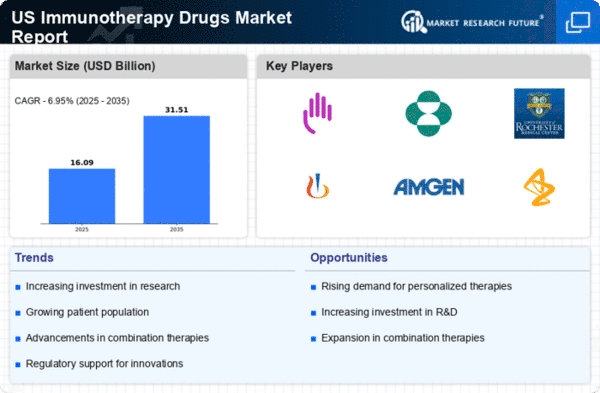

The increasing investment in biotechnology is a significant driver for the immunotherapy drugs market. Venture capital funding for biotech companies has surged, with estimates suggesting that investments reached approximately $30 billion in 2025. This influx of capital is facilitating the development of cutting-edge immunotherapy treatments. Biotech firms are focusing on harnessing the immune system to combat cancer, leading to the emergence of novel therapies. The immunotherapy drugs market stands to benefit from this trend, as innovative products are developed and brought to market. Furthermore, partnerships between biotech companies and larger pharmaceutical firms are likely to enhance research capabilities and accelerate the commercialization of new therapies.

Rising Patient Awareness and Demand

Patient awareness regarding immunotherapy and its benefits is on the rise, significantly impacting the immunotherapy drugs market. Educational campaigns and advocacy groups are actively informing patients about the advantages of immunotherapy in cancer treatment. As of 2025, surveys indicate that nearly 70% of cancer patients are aware of immunotherapy options. This heightened awareness is likely to lead to increased demand for these therapies, as patients seek out the most effective treatment options available. The immunotherapy drugs market is expected to grow as healthcare providers respond to this demand by offering more immunotherapeutic solutions. Additionally, the shift towards patient-centered care is further driving the adoption of immunotherapy.

Advancements in Research and Development

Ongoing advancements in research and development (R&D) are significantly influencing the immunotherapy drugs market. The US is home to numerous leading pharmaceutical companies and research institutions that are investing heavily in R&D. In 2025, it is estimated that R&D spending in the biopharmaceutical sector will exceed $100 billion. This investment is likely to lead to the discovery of novel immunotherapeutic agents and combination therapies that enhance treatment efficacy. Additionally, breakthroughs in understanding the immune system and tumor microenvironment are paving the way for innovative therapies. The immunotherapy drugs market is expected to benefit from these advancements, as new products enter the market and existing therapies are improved, ultimately providing patients with more effective treatment options.