Rising Focus on Patient-Centric Care

The hospital furniture market is increasingly driven by a rising focus on patient-centric care. Healthcare providers are recognizing the importance of creating environments that enhance patient comfort and satisfaction. This shift is leading to the design and procurement of furniture that not only meets functional needs but also contributes to a healing atmosphere. For instance, the use of softer materials, adjustable beds, and aesthetically pleasing designs are becoming more common. Research indicates that patient satisfaction scores are closely linked to the quality of the hospital environment, which includes furniture. As hospitals aim to improve these scores, the demand for innovative and comfortable hospital furniture is likely to grow, indicating a significant trend in the market.

Technological Advancements in Healthcare

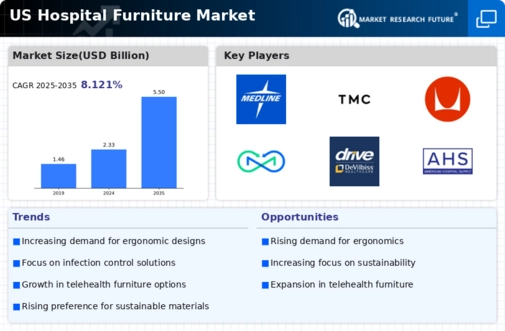

The hospital furniture market is experiencing a notable transformation due to rapid technological advancements in healthcare. Innovations such as integrated monitoring systems and smart beds are becoming increasingly prevalent. These technologies not only enhance patient care but also improve operational efficiency within healthcare facilities. For instance, the incorporation of IoT devices in hospital furniture allows for real-time monitoring of patient conditions, which can lead to better outcomes. The market is projected to grow at a CAGR of approximately 6.5% from 2025 to 2030, driven by these technological enhancements. As hospitals invest in modern furniture solutions, the demand for high-tech hospital furniture is likely to rise, indicating a shift towards more sophisticated healthcare environments.

Regulatory Compliance and Safety Standards

The hospital furniture market is also shaped by stringent regulatory compliance and safety standards imposed by health authorities. Hospitals are required to adhere to specific guidelines regarding the materials and designs used in furniture to ensure patient safety and comfort. For example, the FDA mandates that hospital furniture must be made from non-toxic materials and designed to minimize infection risks. This regulatory landscape compels manufacturers to innovate and produce furniture that meets these standards, which can be a significant driver of market growth. As hospitals strive to maintain compliance, the demand for high-quality, safe hospital furniture is likely to increase, further influencing the market dynamics.

Aging Population and Increased Healthcare Demand

The hospital furniture market is significantly influenced by the aging population in the United States. As the demographic shifts towards an older age group, the demand for healthcare services is expected to rise substantially. This increase in patient volume necessitates the expansion and modernization of hospital facilities, including the procurement of new furniture. According to recent statistics, the population aged 65 and older is projected to reach 80 million by 2040, which will likely drive the need for more hospital beds, examination tables, and other essential furniture. Consequently, healthcare providers are compelled to invest in durable and functional hospital furniture to accommodate this growing demographic, thereby propelling market growth.

Increased Investment in Healthcare Infrastructure

The hospital furniture market is benefiting from increased investment in healthcare infrastructure across the United States. Government initiatives and private sector investments are driving the construction of new hospitals and the renovation of existing facilities. This trend is particularly evident in urban areas where the demand for healthcare services is surging. According to recent reports, healthcare spending in the US is expected to reach $6 trillion by 2027, which includes substantial allocations for hospital furniture. As healthcare facilities expand and modernize, the need for high-quality, durable hospital furniture will likely rise, thereby propelling market growth in the coming years.