Advancements in Processor Technology

Technological advancements in processor technology are playing a pivotal role in shaping the high performance-computing market. The introduction of specialized processors, such as Graphics Processing Units (GPUs) and Application-Specific Integrated Circuits (ASICs), has enhanced computational capabilities, enabling faster processing speeds and improved energy efficiency. These innovations allow organizations to tackle complex simulations and data analyses that were previously unattainable. The market is witnessing a shift towards heterogeneous computing architectures, which combine different types of processors to optimize performance. This trend is expected to drive the high performance-computing market forward, as organizations increasingly adopt these advanced technologies to enhance their computational power and efficiency.

Rising Demand for Data-Intensive Applications

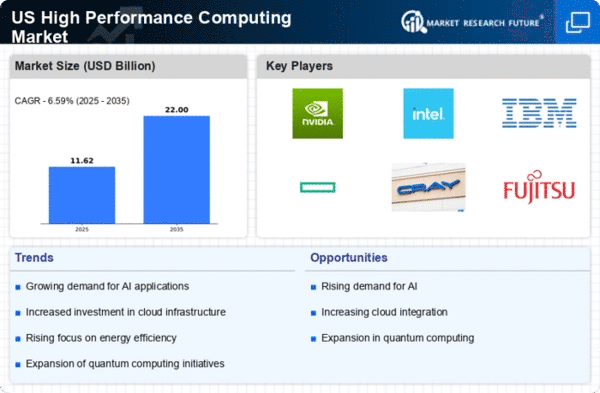

The high performance-computing market is experiencing a surge in demand driven by the proliferation of data-intensive applications across various sectors. Industries such as finance, healthcare, and scientific research are increasingly relying on HPC systems to process vast amounts of data efficiently. For instance, the financial sector utilizes HPC for real-time risk analysis and algorithmic trading, while healthcare employs it for genomic research and personalized medicine. This trend is reflected in the market's projected growth, with estimates suggesting a compound annual growth rate (CAGR) of approximately 7.5% from 2025 to 2030. As organizations seek to leverage big data analytics, the high performance-computing market is poised to expand significantly, catering to the evolving needs of data-driven enterprises.

Growing Investment in Research and Development

Investment in research and development (R&D) is a critical driver of the high performance-computing market. Government agencies, academic institutions, and private enterprises are allocating substantial resources to advance HPC technologies. In the US, federal funding for HPC initiatives has seen a notable increase, with budgets reaching over $1 billion annually. This funding supports the development of next-generation supercomputers and innovative applications in fields such as climate modeling, artificial intelligence, and materials science. As R&D efforts continue to expand, the high performance-computing market is likely to benefit from enhanced capabilities and new applications, fostering further growth and innovation.

Increased Focus on Cybersecurity in HPC Environments

As the high performance-computing market expands, the focus on cybersecurity within HPC environments is becoming increasingly critical. Organizations are recognizing the need to protect sensitive data and intellectual property from cyber threats. This has led to the implementation of advanced security measures, including encryption, access controls, and continuous monitoring. The market is responding to this demand by developing HPC solutions that incorporate robust security features. According to industry reports, investments in cybersecurity for HPC systems are projected to grow by approximately 10% annually. This heightened emphasis on security not only safeguards valuable assets but also enhances the overall trust in HPC technologies, further driving market growth.

Emergence of Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) into the high performance-computing market is transforming how organizations approach data processing and analysis. AI and ML algorithms require substantial computational resources, which HPC systems are uniquely positioned to provide. This synergy enables faster training of models and more efficient data handling, leading to improved decision-making across various industries. The market is witnessing a growing trend where organizations leverage HPC to enhance their AI capabilities, with projections indicating that the AI sector could contribute significantly to the overall growth of the high performance-computing market. As AI applications proliferate, the demand for robust HPC solutions is expected to rise.