Government Initiatives and Funding

Government initiatives aimed at improving women's health are playing a crucial role in the expansion of the gynecological devices-instruments market. Various federal and state programs are providing funding for research and development in women's health technologies. For example, the National Institutes of Health (NIH) has allocated substantial resources to support studies focused on gynecological health. These initiatives not only foster innovation but also encourage collaboration between public and private sectors. As a result, manufacturers are likely to benefit from increased investment in the development of new devices and instruments, thereby enhancing the overall market landscape.

Growing Focus on Patient-Centric Care

The gynecological devices market is witnessing a paradigm shift towards patient-centric care. Healthcare providers are increasingly prioritizing patient preferences and experiences in treatment decisions. This trend is reflected in the development of devices that are designed with user-friendly features and improved ergonomics. As patients become more involved in their healthcare choices, the demand for instruments that enhance comfort and accessibility is expected to grow. This focus on patient-centricity not only improves satisfaction but also encourages adherence to treatment plans. Consequently, manufacturers who can align their product offerings with this trend are likely to gain a competitive edge in the gynecological devices-instruments market.

Rising Incidence of Gynecological Disorders

The prevalence of gynecological disorders, including endometriosis, fibroids, and cervical cancer, is contributing to the growth of the gynecological devices-instruments market. Recent statistics indicate that approximately 1 in 10 women in the US suffer from endometriosis, leading to increased demand for diagnostic and therapeutic devices. Furthermore, the rising incidence of cervical cancer has prompted healthcare providers to enhance screening and treatment options. As awareness of these conditions grows, so does the need for specialized instruments, such as hysteroscopes and colposcopes. This trend suggests a robust market potential for manufacturers who can provide effective solutions tailored to these specific health challenges.

Technological Integration in Healthcare Systems

The integration of advanced technologies into healthcare systems is significantly impacting the gynecological devices-instruments market. The adoption of electronic health records (EHR) and telemedicine is facilitating better patient management and follow-up care. This technological evolution allows for more efficient data sharing and enhances the overall patient experience. As healthcare providers increasingly utilize these technologies, the demand for compatible gynecological instruments is likely to rise. For instance, devices that can seamlessly integrate with EHR systems are becoming essential. This trend indicates a shift towards a more interconnected healthcare environment, which could drive growth in the gynecological devices-instruments market.

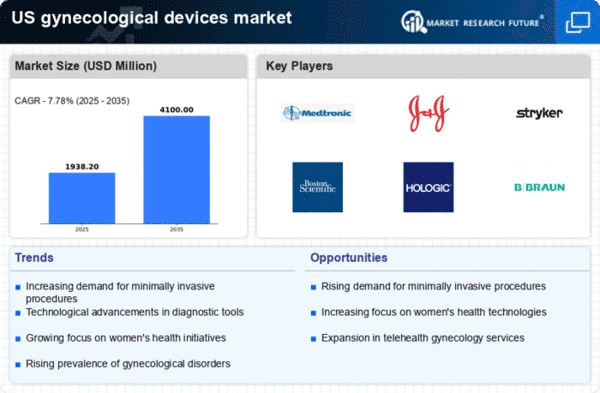

Increasing Demand for Minimally Invasive Procedures

The gynecological devices market is experiencing a notable shift towards minimally invasive procedures. This trend is driven by patient preferences for reduced recovery times and lower risks of complications. According to recent data, minimally invasive surgeries account for approximately 60% of all gynecological procedures in the US. As healthcare providers adopt advanced technologies, such as laparoscopic instruments and robotic-assisted systems, the demand for these devices is expected to rise. This shift not only enhances patient outcomes but also aligns with the broader trend of improving surgical efficiency. Consequently, manufacturers are focusing on developing innovative instruments that cater to this growing demand, thereby propelling the gynecological devices-instruments market forward.