Growth in Automotive Industry

The grinding machinery market is significantly influenced by the growth of the automotive industry, which remains a key driver of demand for grinding equipment. In 2025, the US automotive sector is projected to generate revenues exceeding $800 billion, with a substantial portion allocated to manufacturing processes that require grinding machinery. The increasing complexity of automotive components, such as engine parts and transmission systems, necessitates advanced grinding solutions to achieve the required tolerances and surface finishes. Furthermore, the shift towards electric vehicles (EVs) is likely to create new opportunities for grinding machinery manufacturers, as the production of EV components often requires specialized grinding techniques. This evolving landscape within the automotive industry suggests a sustained demand for grinding machinery, positioning it as a critical component of the manufacturing ecosystem.

Expansion of Manufacturing Sector

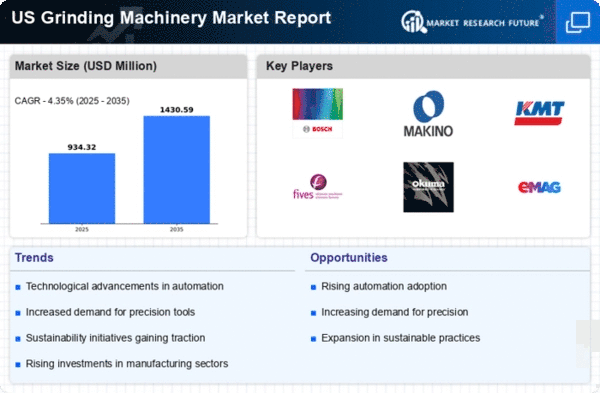

The grinding machinery market is poised for growth due to the ongoing expansion of the manufacturing sector in the United States. As the economy continues to recover and evolve, manufacturing output is expected to increase, leading to a higher demand for grinding machinery. According to recent data, the manufacturing sector contributed approximately $2.3 trillion to the US economy in 2025, reflecting a growth rate of around 4% compared to the previous year. This expansion is likely to drive investments in grinding machinery, as manufacturers seek to optimize their production processes and improve efficiency. Additionally, the trend towards automation in manufacturing is expected to further boost the grinding machinery market, as companies invest in advanced technologies to enhance productivity and reduce operational costs.

Rising Demand for Precision Engineering

The grinding machinery market is experiencing a notable surge in demand driven by the increasing need for precision engineering across various sectors. Industries such as aerospace, automotive, and medical devices require high-precision components, which necessitate advanced grinding technologies. The market for precision engineering is projected to grow at a CAGR of approximately 6% from 2025 to 2030, indicating a robust expansion. This growth is likely to propel the grinding machinery market, as manufacturers seek to enhance their production capabilities to meet stringent quality standards. Furthermore, the integration of computer numerical control (CNC) technology in grinding machines is enhancing precision and efficiency, thereby attracting more investments in this segment. As a result, the grinding machinery market is poised to benefit significantly from the rising demand for precision-engineered products.

Technological Innovations in Grinding Processes

Technological innovations are playing a pivotal role in shaping the grinding machinery market. The introduction of advanced grinding techniques, such as high-efficiency deep grinding and ultra-precision grinding, is enhancing the capabilities of grinding machines. These innovations not only improve the quality of finished products but also increase production efficiency, thereby attracting manufacturers to invest in modern grinding solutions. The market is witnessing a shift towards smart grinding machines equipped with IoT capabilities, enabling real-time monitoring and data analysis. This trend is expected to enhance operational efficiency and reduce downtime, further driving the growth of the grinding machinery market. As manufacturers increasingly adopt these technologies, the competitive landscape is likely to evolve, with a focus on innovation and efficiency.

Increased Focus on Customization and Flexibility

The grinding machinery market is experiencing a shift towards customization and flexibility in manufacturing processes. As industries demand more tailored solutions to meet specific production requirements, manufacturers are increasingly investing in versatile grinding machines that can accommodate a range of applications. This trend is particularly evident in sectors such as aerospace and medical devices, where unique specifications are commonplace. The ability to customize grinding processes not only enhances product quality but also improves operational efficiency. Furthermore, the growing trend of small-batch production is likely to drive the demand for flexible grinding machinery, as manufacturers seek to adapt to changing market needs. This focus on customization and flexibility is expected to be a key driver of growth in the grinding machinery market, as companies strive to remain competitive in a dynamic manufacturing landscape.