Increasing Energy Demand

The gas turbine market is experiencing a notable surge in demand driven by the increasing energy requirements across various sectors in the US. As the population grows and industrial activities expand, the need for reliable and efficient power generation becomes paramount. The US Energy Information Administration (EIA) projects that electricity consumption will rise by approximately 1.5% annually through 2030. This escalating demand necessitates the deployment of advanced gas turbines, which are known for their efficiency and lower emissions compared to traditional coal-fired plants. Consequently, the gas turbine market is poised for growth as utilities and independent power producers invest in new installations and upgrades to meet this rising energy demand.

Investment in Infrastructure Modernization

The gas turbine market benefits from substantial investments in infrastructure modernization across the US. Aging power plants are being replaced or upgraded to enhance efficiency and reliability. The American Society of Civil Engineers (ASCE) has highlighted the need for over $4 trillion in infrastructure improvements by 2025, which includes power generation facilities. This modernization effort often involves the integration of advanced gas turbine technologies that offer improved performance and lower operational costs. As utilities seek to comply with regulatory requirements and meet consumer expectations for reliable power, the gas turbine market is likely to see increased activity and investment in new projects.

Shift Towards Decentralized Energy Systems

The gas turbine market is increasingly influenced by the shift towards decentralized energy systems in the US. As consumers and businesses seek greater energy independence and resilience, distributed generation technologies, including gas turbines, are gaining traction. This trend is particularly evident in the rise of microgrids and combined heat and power (CHP) systems, which utilize gas turbines to provide localized energy solutions. The US Department of Energy has reported a growing interest in these systems, with projections indicating that the market for distributed energy resources could reach $100 billion by 2030. This shift not only enhances energy security but also drives the gas turbine market as more entities invest in on-site generation capabilities.

Regulatory Support for Cleaner Technologies

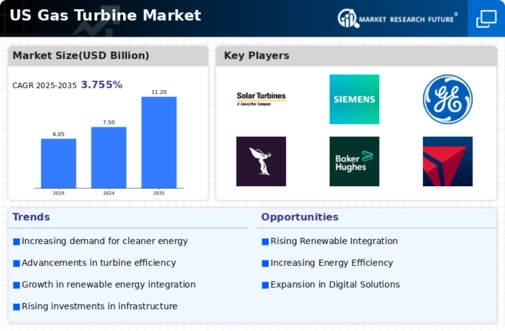

The gas turbine market is significantly influenced by regulatory frameworks that promote cleaner energy technologies. The US government has implemented various policies aimed at reducing greenhouse gas emissions, which encourages the adoption of natural gas as a cleaner alternative to coal. The Environmental Protection Agency (EPA) has set stringent emissions standards that gas turbines can meet more easily than other fossil fuel technologies. As a result, investments in gas turbine technology are likely to increase, with projections indicating a potential market growth of 5% annually through 2027. This regulatory support not only enhances the attractiveness of gas turbines but also aligns with broader sustainability goals, thereby driving the gas turbine market forward.

Technological Innovations in Turbine Design

The gas turbine market is witnessing technological innovations that significantly enhance turbine design and performance. Advances in materials science, aerodynamics, and digital controls are leading to the development of more efficient and powerful gas turbines. For instance, the introduction of advanced cooling techniques and high-temperature materials allows turbines to operate at higher efficiencies, potentially exceeding 60% in combined cycle applications. This innovation not only reduces fuel consumption but also lowers emissions, making gas turbines more competitive in the energy market. As these technologies continue to evolve, the gas turbine market is expected to expand, driven by the demand for high-performance energy solutions.