Increased Government Investment

The US Fiber To The Premises Market is experiencing a notable surge in government investment aimed at expanding broadband access. Federal initiatives, such as the Infrastructure Investment and Jobs Act, allocate substantial funds to enhance fiber optic infrastructure, particularly in underserved areas. This investment is projected to facilitate the deployment of high-speed internet services to millions of households, thereby stimulating economic growth and improving digital equity. As of January 2026, the government has committed billions to support local and state broadband projects, which is likely to accelerate the adoption of fiber-to-the-premises technology. This influx of funding not only enhances the market landscape but also encourages private sector participation, fostering a competitive environment that could lead to innovative solutions and improved service offerings in the US Fiber To The Premises Market.

Regulatory Support and Policy Framework

The US Fiber To The Premises Market is significantly shaped by regulatory support and a favorable policy framework. Federal and state governments are increasingly recognizing the importance of broadband access as a critical infrastructure component. Policies aimed at reducing barriers to fiber deployment, such as streamlined permitting processes and funding incentives, are being implemented to encourage investment in fiber networks. As of January 2026, these regulatory measures are expected to facilitate the expansion of fiber optic services, particularly in rural and underserved areas. The supportive policy environment not only enhances the attractiveness of the US Fiber To The Premises Market for investors but also ensures that a broader segment of the population gains access to high-speed internet, thereby promoting digital inclusion and economic development.

Technological Advancements in Fiber Optics

The US Fiber To The Premises Market is significantly influenced by ongoing technological advancements in fiber optics. Innovations such as improved fiber materials, enhanced installation techniques, and advanced network management systems are contributing to the efficiency and cost-effectiveness of fiber deployments. These advancements enable service providers to offer higher bandwidth capabilities and more reliable connections, which are essential in meeting the increasing demands of consumers and businesses alike. As of January 2026, the integration of technologies like passive optical networks (PON) and wavelength division multiplexing (WDM) is becoming more prevalent, allowing for greater data transmission over existing fiber infrastructure. This technological evolution not only enhances service quality but also positions the US Fiber To The Premises Market for sustained growth as providers seek to leverage these innovations to attract and retain customers.

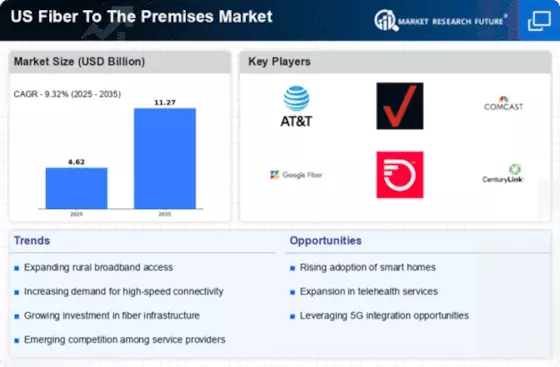

Competitive Landscape and Market Consolidation

The US Fiber To The Premises Market is characterized by a dynamic competitive landscape, with numerous players vying for market share. This competition is driving innovation and service differentiation, as companies strive to offer superior products and customer experiences. Additionally, market consolidation is becoming increasingly evident, as larger telecommunications firms acquire smaller providers to expand their fiber networks and enhance service offerings. This trend is likely to reshape the competitive dynamics within the US Fiber To The Premises Market, as consolidated entities can leverage economies of scale to reduce costs and improve service delivery. As of January 2026, the implications of this consolidation may lead to a more streamlined market, potentially benefiting consumers through improved service options and pricing strategies.

Rising Consumer Demand for High-Speed Internet

The US Fiber To The Premises Market is witnessing a significant increase in consumer demand for high-speed internet services. As digital consumption continues to rise, driven by remote work, online education, and streaming services, consumers are increasingly seeking reliable and fast internet connections. According to recent surveys, a substantial percentage of households express a preference for fiber optic services due to their superior speed and reliability compared to traditional broadband options. This growing demand is prompting service providers to invest in fiber infrastructure, thereby expanding their offerings in the US Fiber To The Premises Market. The trend suggests that as more consumers recognize the benefits of fiber optics, the market is likely to experience accelerated growth, with providers racing to meet the evolving needs of their customer base.