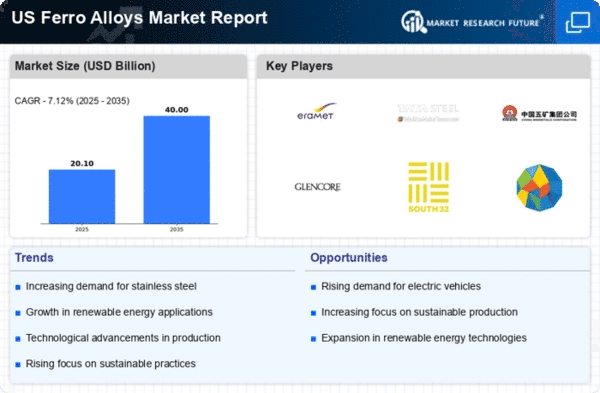

Rising Demand from Steel Industry

The US Ferro Alloys Market is experiencing a notable surge in demand, primarily driven by the steel sector. As steel production continues to expand, the need for ferro alloys, which enhance the properties of steel, becomes increasingly critical. In 2025, the steel industry is projected to consume approximately 70% of the total ferro alloys produced in the United States. This trend indicates a robust correlation between steel manufacturing and ferro alloys, suggesting that any fluctuations in steel demand will directly impact the ferro alloys market. Furthermore, the ongoing infrastructure projects across the country are likely to bolster steel consumption, thereby further stimulating the ferro alloys market. As such, the steel industry's growth trajectory appears to be a pivotal driver for the US Ferro Alloys Market.

Government Regulations and Standards

The regulatory landscape surrounding the US Ferro Alloys Market is becoming increasingly stringent, with government policies aimed at promoting environmental sustainability and safety. Regulations concerning emissions and waste management are compelling manufacturers to adopt cleaner production methods. In 2025, compliance with these regulations is expected to drive investments in eco-friendly technologies, which may enhance the overall competitiveness of the US ferro alloys sector. Moreover, adherence to safety standards is crucial for maintaining market access, particularly in industries such as construction and automotive. As manufacturers navigate these regulatory challenges, the ability to innovate and comply with standards will likely serve as a significant driver for growth within the US Ferro Alloys Market. This evolving regulatory framework may also encourage collaboration between industry stakeholders to develop sustainable practices.

Technological Innovations in Production

Technological advancements in the production processes of ferro alloys are significantly influencing the US Ferro Alloys Market. Innovations such as electric arc furnaces and improved smelting techniques are enhancing efficiency and reducing production costs. These advancements not only increase output but also minimize environmental impact, aligning with the industry's sustainability goals. In 2025, it is estimated that these technologies could lead to a 15% increase in production efficiency, thereby meeting the rising demand without compromising quality. Additionally, the integration of automation and data analytics in production processes is expected to optimize resource utilization, further solidifying the competitive edge of US ferro alloys manufacturers. Consequently, these technological innovations are likely to play a crucial role in shaping the future landscape of the US Ferro Alloys Market.

Global Market Dynamics and Trade Policies

The US Ferro Alloys Market is intricately linked to global market dynamics and trade policies. Changes in international trade agreements and tariffs can have profound effects on the supply and pricing of ferro alloys. In 2025, fluctuations in demand from key importing countries may influence domestic production strategies, as manufacturers seek to optimize their market positions. Additionally, geopolitical factors and trade tensions could lead to shifts in sourcing strategies, prompting US producers to explore new markets or diversify their supply chains. This interconnectedness suggests that the US ferro alloys sector must remain agile and responsive to global trends. Consequently, the evolving landscape of trade policies and international market conditions is likely to be a critical driver for the US Ferro Alloys Market.

Increasing Applications in Aerospace and Automotive

The US Ferro Alloys Market is witnessing a diversification of applications, particularly in the aerospace and automotive sectors. The demand for high-performance alloys in these industries is escalating, driven by the need for lightweight and durable materials. In 2025, it is projected that the aerospace sector will account for a significant share of ferro alloys consumption, as manufacturers seek to enhance fuel efficiency and reduce emissions. Similarly, the automotive industry is increasingly utilizing ferro alloys to produce components that meet stringent safety and performance standards. This shift towards advanced materials is likely to create new opportunities for ferro alloys producers, as they adapt to the evolving requirements of these high-tech industries. Thus, the expanding applications in aerospace and automotive sectors are poised to be a vital driver for the US Ferro Alloys Market.