Regulatory Compliance

Regulatory compliance is a critical driver for the US Epoxy Coatings Market. Stringent regulations imposed by agencies such as the Environmental Protection Agency (EPA) necessitate the formulation of coatings that adhere to safety and environmental standards. Compliance with regulations regarding VOC emissions and hazardous substances is essential for manufacturers to maintain market access and avoid penalties. As a result, there is a growing emphasis on developing compliant products that do not compromise performance. This focus on regulatory adherence is expected to drive innovation in the formulation of epoxy coatings, leading to the introduction of safer, more efficient products. The US Epoxy Coatings Market is likely to see a shift towards compliance-driven product development, influencing market dynamics and competitive strategies.

Sustainability Initiatives

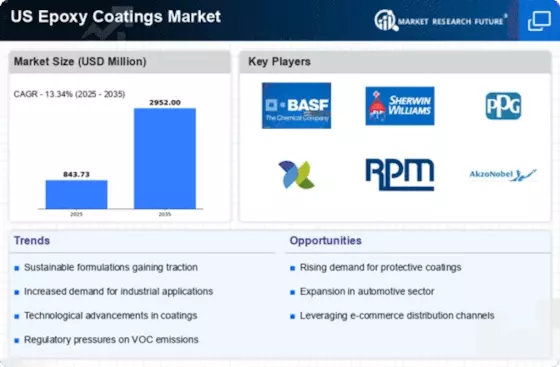

The US Epoxy Coatings Market is increasingly influenced by sustainability initiatives. As environmental concerns gain prominence, manufacturers are focusing on developing eco-friendly epoxy coatings that minimize harmful emissions and utilize renewable resources. This shift is driven by regulatory frameworks such as the Clean Air Act, which encourages the adoption of low-VOC (volatile organic compounds) products. The market for sustainable coatings is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of over 5% in the coming years. Companies that prioritize sustainability not only comply with regulations but also appeal to environmentally conscious consumers, thereby enhancing their market position. This trend is likely to reshape product offerings and drive innovation within the US Epoxy Coatings Market.

Technological Advancements

Technological advancements play a pivotal role in shaping the US Epoxy Coatings Market. Innovations in formulation chemistry and application techniques have led to the development of high-performance epoxy coatings that offer superior durability, adhesion, and resistance to chemicals and abrasion. For instance, the introduction of nanotechnology in epoxy formulations has resulted in coatings with enhanced properties, catering to diverse applications across industries such as aerospace, automotive, and construction. The market is witnessing a surge in demand for advanced coatings that can withstand extreme conditions, with growth rates projected to reach 6% annually. As manufacturers invest in research and development, the US Epoxy Coatings Market is expected to benefit from a continuous influx of innovative products that meet evolving customer needs.

Rising Demand for Protective Coatings

The rising demand for protective coatings is a significant driver of the US Epoxy Coatings Market. Industries such as oil and gas, marine, and manufacturing require coatings that provide long-lasting protection against corrosion, chemicals, and environmental degradation. Epoxy coatings are particularly valued for their exceptional protective properties, making them a preferred choice for various applications. The market is witnessing an increasing trend towards the use of epoxy coatings in infrastructure projects, where durability and longevity are paramount. With infrastructure spending projected to increase, the demand for high-performance protective coatings is expected to rise correspondingly. This trend indicates a robust growth trajectory for the US Epoxy Coatings Market, as manufacturers respond to the escalating need for reliable protective solutions.

Growth in Construction and Automotive Sectors

The growth in the construction and automotive sectors significantly impacts the US Epoxy Coatings Market. With the construction industry projected to expand at a CAGR of 4.5% through 2026, the demand for protective coatings in residential, commercial, and industrial applications is on the rise. Epoxy coatings are favored for their excellent adhesion and resistance to wear, making them ideal for flooring, walls, and protective surfaces. Similarly, the automotive sector's recovery and expansion, driven by increasing vehicle production and sales, further bolster the demand for epoxy coatings used in vehicle manufacturing and maintenance. This dual growth trajectory is likely to propel the US Epoxy Coatings Market, creating opportunities for manufacturers to innovate and diversify their product lines.