Increasing Cybersecurity Threats

The endpoint detection-response market is experiencing growth due to the escalating frequency and sophistication of cyber threats. Organizations in the US are increasingly targeted by ransomware, phishing, and advanced persistent threats (APTs). In 2025, it is estimated that cybercrime will cost businesses globally over $10 trillion annually, prompting a heightened focus on robust cybersecurity measures. As a result, companies are investing in endpoint detection-response solutions to enhance their security posture. The need for real-time threat detection and response capabilities is becoming paramount, as organizations seek to mitigate risks associated with data breaches and financial losses. This trend indicates a strong demand for advanced endpoint detection-response technologies, which are essential for safeguarding sensitive information and maintaining operational integrity.

Growing Adoption of Cloud Services

The endpoint detection-response market is witnessing growth due to the increasing adoption of cloud services by organizations in the US. As businesses migrate to cloud-based infrastructures, they face new security challenges that traditional endpoint protection may not adequately address. In 2025, the cloud security market is projected to reach $50 billion, indicating a robust demand for integrated endpoint detection-response solutions that can operate seamlessly in cloud environments. This trend suggests that organizations are prioritizing comprehensive security strategies that encompass both on-premises and cloud-based endpoints. The integration of endpoint detection-response technologies with cloud services is likely to enhance overall security posture and facilitate better threat management.

Regulatory Pressures and Compliance

The endpoint detection-response market is significantly influenced by the increasing regulatory pressures faced by organizations in the US. Compliance with regulations such as the Health Insurance Portability and Accountability Act (HIPAA) and the General Data Protection Regulation (GDPR) necessitates the implementation of stringent security measures. Companies are compelled to adopt endpoint detection-response solutions to ensure compliance and avoid hefty fines, which can reach millions of dollars. In 2025, the market for compliance-related cybersecurity solutions is projected to grow by 15%, reflecting the urgency for organizations to align with regulatory requirements. This driver highlights the critical role of endpoint detection-response technologies in helping businesses navigate the complex landscape of compliance while protecting sensitive data.

Shift Towards Remote Work Environments

The endpoint detection-response market is adapting to the shift towards remote work environments, which has become increasingly prevalent in the US. As organizations embrace flexible work arrangements, the attack surface for cyber threats expands, necessitating enhanced security measures. In 2025, it is estimated that 30% of the US workforce will be working remotely, creating a pressing need for effective endpoint detection-response solutions. These technologies are essential for securing endpoints that are no longer confined to traditional office networks. The demand for solutions that can monitor, detect, and respond to threats across diverse environments is likely to drive innovation and investment in the endpoint detection-response market.

Rising Demand for Automation in Security Operations

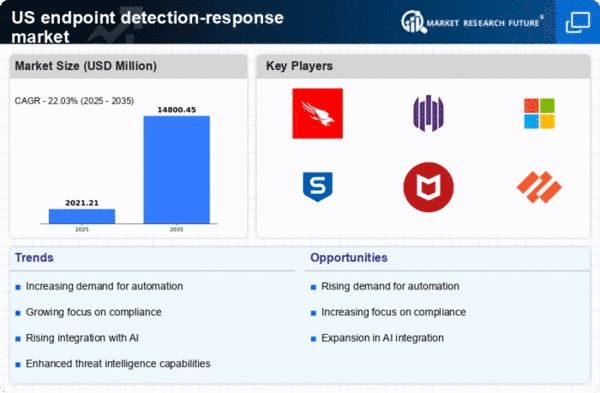

The endpoint detection-response market is being driven by the rising demand for automation in security operations. Organizations in the US are increasingly recognizing the need for efficient and effective security measures to combat the growing complexity of cyber threats. Automation can significantly reduce response times and improve the accuracy of threat detection. In 2025, it is anticipated that automated security solutions will account for over 40% of the endpoint detection-response market. This shift towards automation indicates a broader trend of leveraging technology to enhance security operations, allowing security teams to focus on strategic initiatives rather than routine tasks. The integration of automation within endpoint detection-response solutions is likely to be a key factor in the market's evolution.