Rising Geriatric Population

The endoscopic retrograde-cholangiopancreatography market is poised for growth due to the rising geriatric population in the US. As individuals age, they become more susceptible to various health issues, including biliary and pancreatic disorders. The US Census Bureau projects that the population aged 65 and older will reach approximately 80 million by 2040, creating a larger patient base for endoscopic procedures. This demographic shift is likely to increase the demand for endoscopic retrograde-cholangiopancreatography as healthcare providers seek effective solutions for age-related conditions. Consequently, the market may experience significant expansion as it adapts to the needs of an aging population.

Enhanced Reimbursement Policies

The endoscopic retrograde-cholangiopancreatography market is positively impacted by enhanced reimbursement policies from insurance providers. Recent changes in reimbursement frameworks have made it more financially viable for healthcare facilities to offer endoscopic procedures. This shift encourages more practitioners to adopt endoscopic retrograde-cholangiopancreatography as a preferred method for diagnosing and treating biliary disorders. Improved reimbursement rates can lead to increased procedure volumes, as patients are more likely to seek treatment when financial barriers are reduced. As reimbursement policies continue to evolve favorably, the endoscopic retrograde-cholangiopancreatography market is expected to thrive, reflecting a growing acceptance of these procedures within the healthcare system.

Growing Awareness and Education

The endoscopic retrograde-cholangiopancreatography market is bolstered by growing awareness and education regarding biliary and pancreatic disorders. Increased public and professional knowledge about the symptoms and treatment options available has led to more patients seeking medical attention. Educational initiatives by healthcare organizations aim to inform both patients and providers about the benefits of endoscopic retrograde-cholangiopancreatography as a minimally invasive diagnostic and therapeutic option. This heightened awareness is likely to drive demand for procedures, contributing to market growth. As more individuals recognize the importance of early diagnosis and treatment, the endoscopic retrograde-cholangiopancreatography market may see a corresponding increase in procedure rates.

Advancements in Imaging Technologies

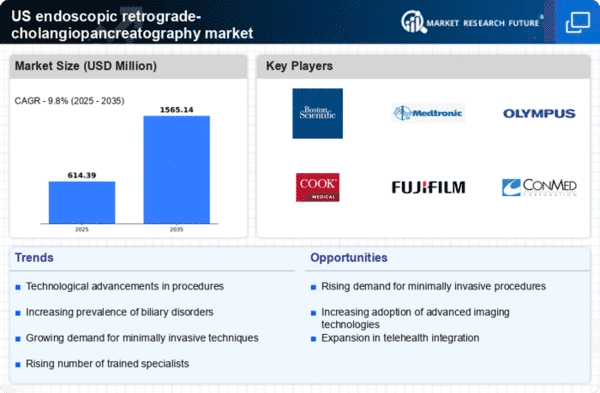

The endoscopic retrograde-cholangiopancreatography market is significantly influenced by advancements in imaging technologies. Innovations such as high-definition endoscopes and enhanced imaging techniques have improved the accuracy and effectiveness of procedures. These technological improvements facilitate better visualization of the biliary and pancreatic ducts, leading to more successful outcomes. The integration of artificial intelligence in imaging analysis is also emerging, potentially enhancing diagnostic capabilities. As healthcare facilities in the US adopt these advanced technologies, the endoscopic retrograde-cholangiopancreatography market is expected to benefit from increased procedure volumes and improved patient outcomes, indicating a positive trajectory for market growth.

Increasing Incidence of Biliary Disorders

The endoscopic retrograde-cholangiopancreatography market is experiencing growth due to the rising incidence of biliary disorders, such as cholangitis and choledocholithiasis. According to recent data, the prevalence of these conditions has been increasing, leading to a higher demand for diagnostic and therapeutic procedures. The American College of Gastroenterology reports that biliary disorders affect millions of individuals in the US annually, necessitating effective treatment options. As healthcare providers seek to address these conditions, the endoscopic retrograde-cholangiopancreatography market is likely to expand, driven by the need for advanced diagnostic tools and interventions. This trend suggests a robust market potential as healthcare systems adapt to the growing burden of biliary diseases.